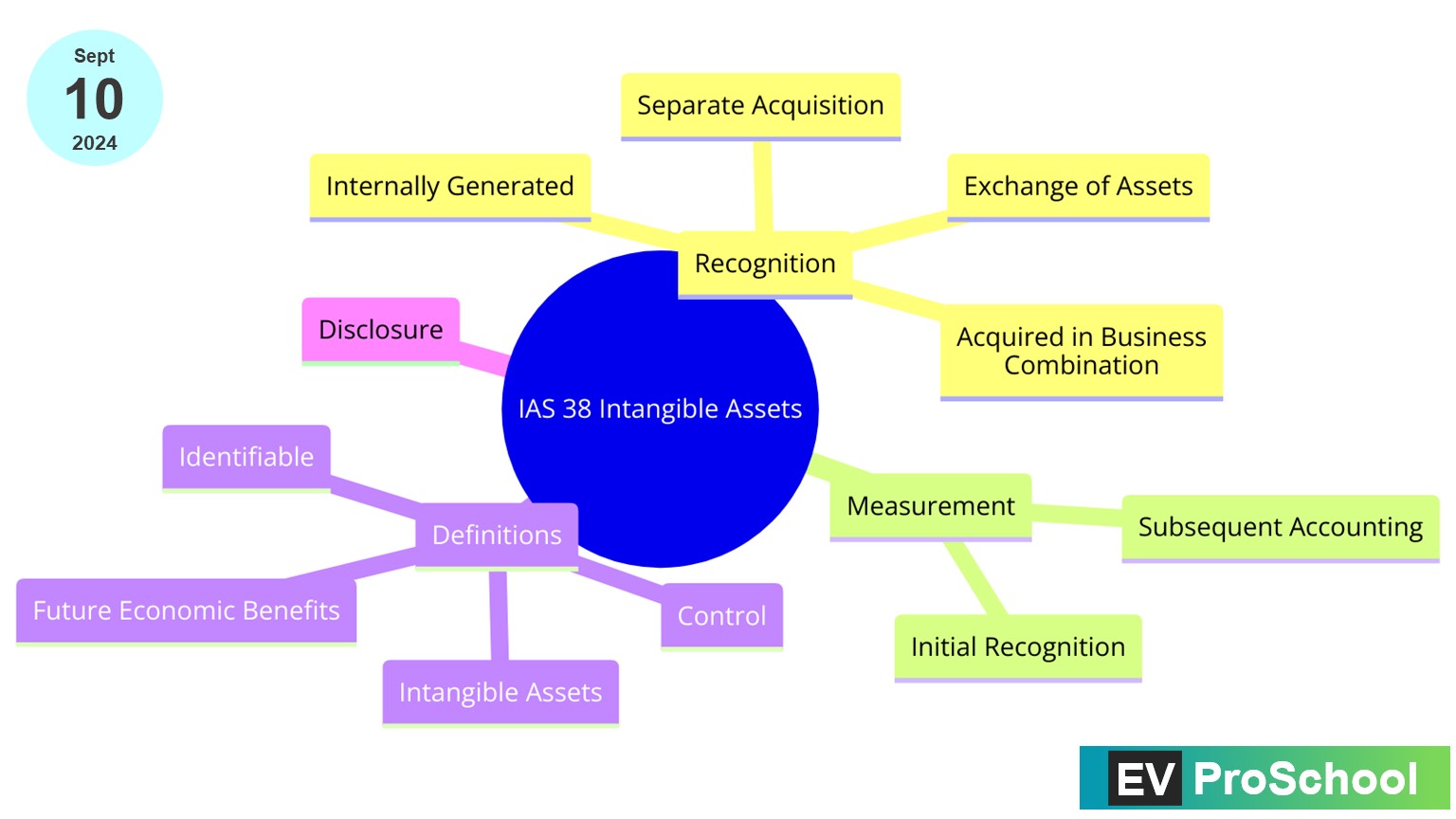

International Accounting Standard (IAS) 38 is a framework that guides the treatment of intangible assets in financial statements. Unlike tangible assets, intangibles are identifiable non-monetary assets without physical substance, which businesses use over time to generate revenue.

Definition of Intangible Assets:

According to IAS 38, an intangible asset is identifiable when it is separable or arises from contractual or other legal rights. It must be controlled by the entity and expected to produce future economic benefits. Examples include patents, trademarks, and software.

An intangible asset is an identifiable, non-monetary asset, without physical substance.

The common misconception that an intangible asset is simply something that cannot be touched (without physical substance) does not fully capture the essence of what constitutes an intangible asset in accounting terms.

Taking a loan as an example, it’s true that a loan is not physical and cannot be touched, but it does not qualify as an intangible asset. This is because a loan represents a financial instrument, specifically a financial liability for the borrower, rather than an asset that the entity controls and from which it expects future economic benefits. In the case of the lender, the loan represents a financial asset. The key aspects of an intangible asset are the control over the expected future economic benefits that the asset will generate for the entity, and the ability to identify this benefit from the entity’s other assets, which is not the case with a loan.

For instance, if a business takes out a loan to purchase a patent, the patent is the intangible asset, not the loan itself. The patent can generate economic benefits through its use in production or licensing, while the loan is a means of financing the purchase of that asset.

Non-monetary assets are those assets that are not in the form of currency and do not have a fixed or determinable money value. Instead, their value comes from the rights and benefits they confer to their owner. These benefits are often not directly convertible to a fixed amount of cash but have value in contributing to future cash flows.

For example:

- Goodwill represents the value of a company’s brand name, solid customer base, good customer relations, good employee relations, and any patents or proprietary technology.

- Royalty refers to the regular payments made for the use of someone else’s property, such as paying royalties to a musician for their music when it is sold or performed.

- Copyright protects the use of an original work like a book or song and allows the owner to benefit from that work.

These are all intangible elements that you can’t hold like cash or inventory, but they can be valuable resources for generating revenue.

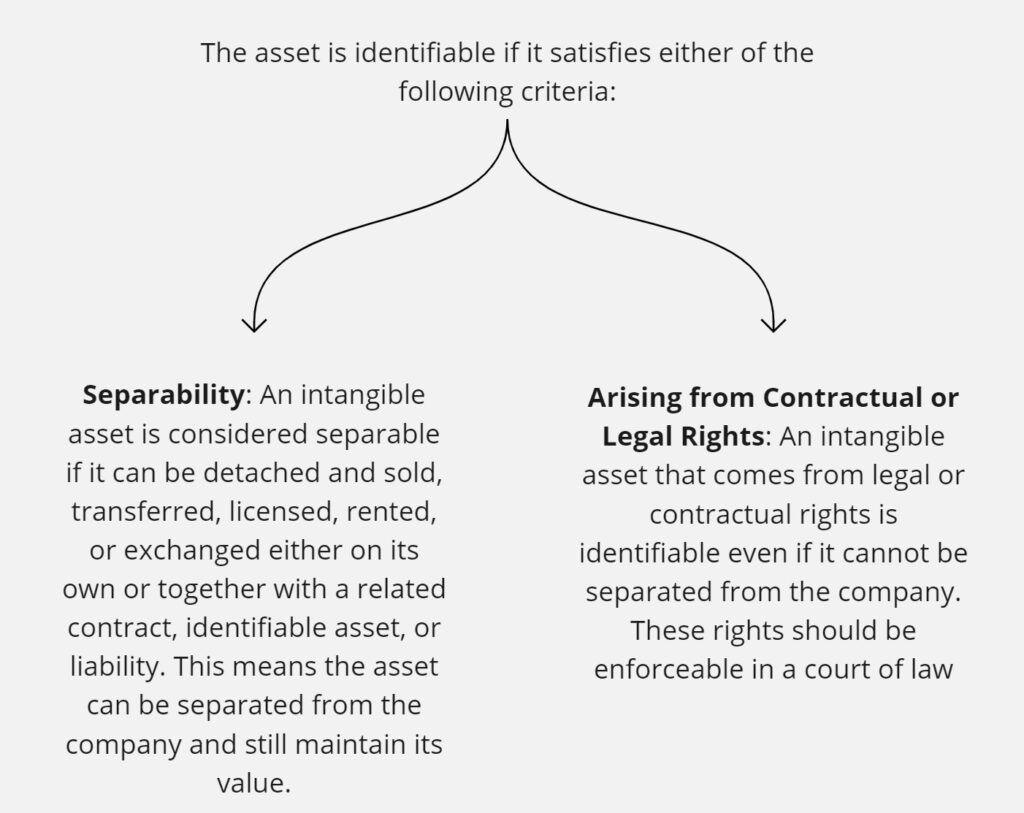

Identifiable: The concept illustrated here is that an intangible asset must be identifiable to be recognized on the balance sheet. For an intangible asset to be identifiable, it must meet one of two criteria:

Condition 1: Separability

Example: A mobile phone manufacturer has developed a unique application software that can be operated on various devices, not just its own. This software is an identifiable intangible asset because it can be separated from the company – it can be sold, licensed, or transferred independently without affecting the operations of the phone manufacturer.

Condition 2: Arising from Contractual or Legal Rights

Example: A beverage company owns a patent for a sugar-free sweetener formula. Even though the patent is not physically separable from the company because it is integral to its products, it is still identifiable. The legal rights afforded by the patent (protection from others using the formula) make it an identifiable intangible asset. The company can enforce these rights legally if another entity tries to use the sweetener formula without permission.

So, in essence, the main takeaway is that for an asset to be considered identifiable and thus an intangible asset, it should either be capable of being separated from the entity or arise from legal rights.

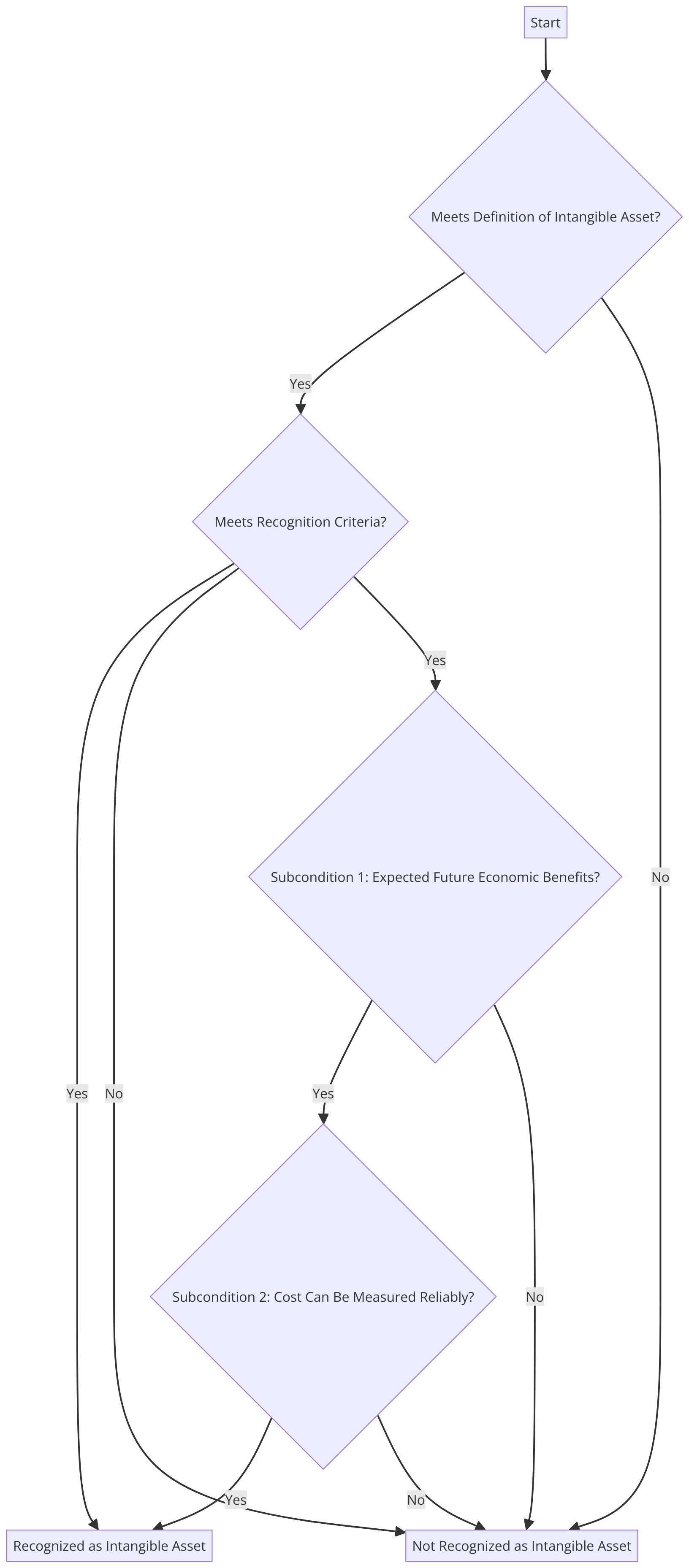

Initial Recognition and Measurement

An intangible asset is initially recognized at cost when the asset is identifiable, the entity controls the asset, and it is probable that future economic benefits will flow to the entity. The cost includes the purchase price and any directly attributable costs of preparing the asset for its intended use.

How to Initially Recognize Intangible Asset:

Initial recognition of an intangible asset occurs when a company is able to clearly define the future economic benefits the asset will bring and when the cost of the asset can be determined with accuracy.

Future Economic Benefits Example:

ElectraTech Pvt Ltd. develops a new software algorithm that improves the efficiency of electric vehicle batteries. The company conducted extensive market research that indicates high demand for such innovation. Management is confident that licensing this software to EV manufacturers will bring significant royalties, thereby satisfying the “probable future economic benefits” criterion.

Reliable Measurement of Cost Example:

For the software algorithm, ElectraTech Pvt Ltd. has a detailed breakdown of costs incurred during its development, including research hours, testing expenses, and relevant overheads. They also have contractual agreements specifying the licensing costs. These clear records allow the company to reliably measure the cost of the asset.

By satisfying both sub-conditions, ElectraTech can recognize its software algorithm as an intangible asset on its balance sheet at the initial cost of development. Over time, this asset will be subject to amortization as its value is systematically allocated over its useful life.

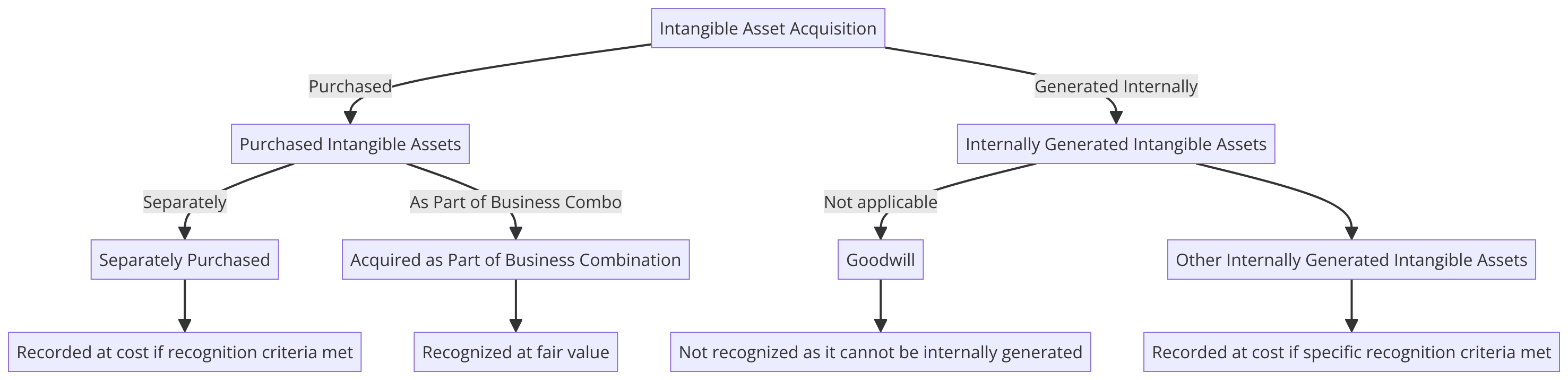

Intangible Asset Acquisition

When an entity acquires an intangible asset, there are two primary sources:

a) Separately Purchased:

Intangible assets purchased independently should be recorded at cost if they meet the recognition criteria. The cost includes purchase price, import duties, and other directly attributable costs of preparing the asset for its intended use.

Example: A company acquires a patent for a cutting-edge electric vehicle battery technology at a cost of ₹2 million. This figure includes the purchase price of the patent, import duties, and non-refundable purchase taxes. From this cost, the company deducts any trade discounts and rebates it received on the acquisition to arrive at the net cost of the intangible asset.

The patent, on the balance sheet is not just limited to its purchase price. It encompasses all expenditures that can be directly attributed to the asset’s development and preparation for its intended use. If the company employs a team of engineers and scientists specifically for the development phase of the battery technology covered by the patent, their salaries would be included in the capitalized cost of the patent. Similarly, any fees paid to external consultants for their specialized services that are directly linked to ensuring that the patent meets the required standards for commercial use would also be included.

Conversely, costs that cannot be directly linked to the patent itself are excluded. This means any general marketing costs, the expense of training staff to sell the new product, or overhead costs like the rent of the office space cannot be capitalized as part of the patent’s cost. These costs are considered to be more associated with the broader activities of the company rather than the preparation of the patent for its intended use. As a result, they are expensed in the income statement as incurred, rather than being included in the capitalized cost of the intangible asset.

By distinguishing between directly attributable costs and those that are more general in nature, the company ensures that only the true costs associated with bringing the intangible asset to a condition ready for use are reflected on its balance sheet, thus giving a fairer representation of the asset’s value to the business.

b) Acquired as Part of Business Combination:

When intangible assets are acquired as part of a business combination, they are recognized at their fair value at the acquisition date if they are identifiable and their fair value (FV) can be measured reliably.

Example: An EV company acquires another company that has developed proprietary software for autonomous driving. The fair value of the software is assessed at ₹10 million at the time of acquisition and is recorded as an intangible asset at this fair value.

c) Goodwill:

Goodwill, often recognized in a business combination, cannot be internally generated and thus is not recognized as an intangible asset in this context because it is not an identifiable resource controlled by the entity and it lacks a measurable reliable cost.

Example: The same EV company buys out a competitor and pays ₹50 million in total, while the fair value of the net identifiable assets of the competitor is ₹40 million. The excess ₹10 million paid is recognized as goodwill and arises because the purchase price reflects things like the acquired company’s reputation, customer relationships, and employee skills.

d) Other Internally Generated Intangible Assets:

Other internally generated intangible assets are recorded at cost if they meet the specific recognition criteria. This includes costs that can be directly attributed to creating the asset and preparing it for its intended use.

Example: The EV company spends ₹5 million on research and development over two years to create a new battery technology. However, the costs associated with research are expensed as they are incurred. Once the development phase reaches a point where the battery technology is commercially viable (the recognition criteria are met), the company capitalizes the subsequent costs associated with the development of this technology.

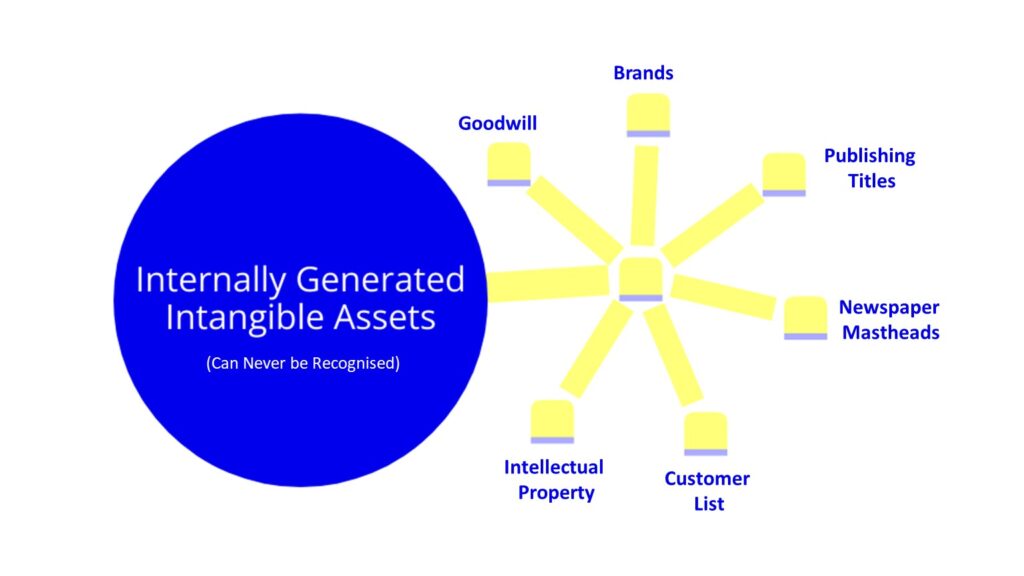

Internally generated intangible assets that cannot be capitalized on SOFP:

- Goodwill: Reflects the future economic benefits from assets that cannot be individually identified and separately recognized; it is only recognized as part of a business combination.

- Brands: Recognizing internally developed brands is prohibited since it’s challenging to measure the cost reliably separate from the cost of developing the business as a whole.

- Publishing Titles: Like brands, these are typically entwined with the entity’s overall development costs and cannot be reliably measured.

- Newspaper Mastheads: These are similar to brands and publishing titles, often developed through ongoing business operations and not separable for individual recognition.

- Customer Lists: Although they can be valuable, the costs associated with developing customer relationships are often indistinguishable from other marketing and sales activities.

- Intellectual Property: Unless acquired from an external party or it is part of a business combination, internally generated intellectual property like patents or copyrights is not recognized due to the difficulty in isolating costs for its development from everyday business operations.

Subsequent Recognition and Measurement

After initial recognition, IAS 38 allows entities to choose between the cost model and the revaluation model for subsequent measurement of intangible assets.

At the year end how to record the transaction is nothing but a subsequent measurement

Subsequent measurement of intangible assets involves accounting for the changes in value of an asset after its initial recognition. For intangible assets, this can generally be done using one of two methods: Cost model & Revaluation model (which is less common).

- Cost Model: After initial recognition, the intangible asset is carried at its cost less any accumulated amortization and any accumulated impairment losses. The amortization expense should be charged to profit or loss on a systematic basis over the asset’s useful life, unless the asset has an indefinite useful life. If it’s indefinite, the asset isn’t amortized but is tested for impairment annually.

- Revaluation Model: This model allows for revaluation of an intangible asset to its fair value at the revaluation date less any subsequent accumulated amortization and subsequent accumulated impairment losses. Revaluations should be made with sufficient regularity to ensure that the carrying amount does not differ materially from that which would be determined using fair value at the end of the reporting period. Increases in the carrying amount arising from revaluation are credited to other comprehensive income and accumulated in equity under the revaluation surplus. However, they can also be recognized in profit or loss to the extent that they reverse a revaluation decrease of the same asset previously recognized in profit or loss. Decreases in carrying amount are recognized in profit or loss unless they offset a previous increase for the same asset in other comprehensive income, in which case they are taken to equity.

Recording the year-end transaction for an intangible asset under subsequent measurement would look like this:

For the Cost Model:

- Debit: Amortization Expense (Profit or Loss)

- Credit: Accumulated Amortization (Statement of Financial Position)

For the Revaluation Model:

- If an increase in value:

- Debit: Intangible Asset (Statement of Financial Position)

- Credit: Revaluation Surplus (Equity)

- If a decrease in value:

- Debit: Impairment Loss (Profit or Loss) or Revaluation Surplus (Equity) if offsetting previous surplus

- Credit: Intangible Asset (Statement of Financial Position)

Note: Any impairment loss identified during the annual impairment review will be recorded as an expense in profit or loss, and the carrying value of the asset will be decreased accordingly.

The specific entries can vary depending on the asset’s circumstances and the applicable financial reporting framework.

Intangible assets represent significant investments for many entities, and managing them according to IAS 38 “Intangible Assets” under International Financial Reporting Standards (IFRS) is vital for accurate financial reporting. Two key aspects of managing intangible assets are impairment testing and derecognition.

Intangible Assets- Impairment and Derecognition

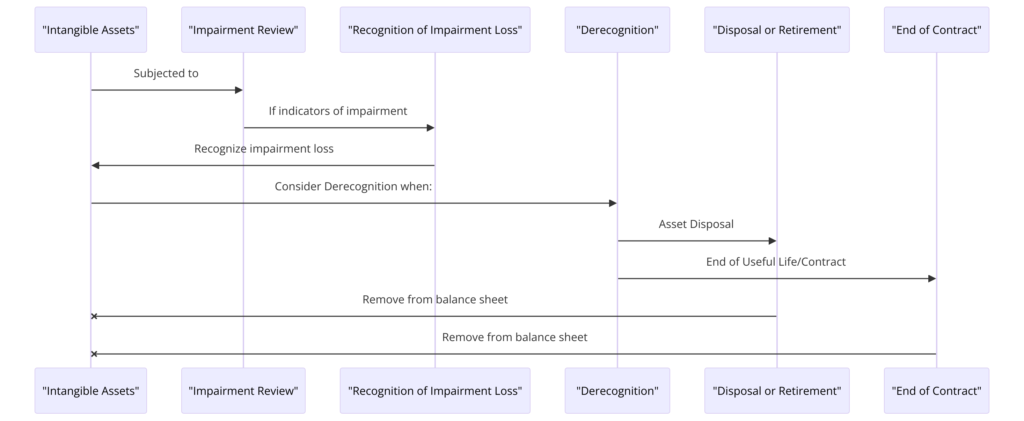

The below sequence diagram describes the process of impairment and derecognition of intangible assets.

Intangible Assets- Impairment

Act of impairing something or the state or condition of being impaired : diminishment or loss of function or ability.

- Intangible Assets (IA) Subjected to Impairment Review (I): This initiates when the intangible asset is reviewed for signs of impairment. This is a regular check to ensure the asset’s book value does not exceed its recoverable amount.

- If Indicators of Impairment: If there are indications that the asset may be impaired (for instance, if its value on the balance sheet is higher than its estimated future cash flows), the impairment review process begins.

- Recognition of Impairment Loss (R): If the impairment review concludes that the asset is indeed impaired, an impairment loss is recognized. This means that the asset’s carrying amount on the balance sheet is reduced to its recoverable amount, and the loss is reported on the income statement.

Example: Impairment Review for a Software Company

Imagine ByteRight Software Co., a tech firm that has developed a proprietary software platform. ByteRight initially capitalized the development costs as an intangible asset at a value of ₹50 million based on its expected future profitability.

During its annual impairment review, ByteRight examines the following:

- Market Changes: There has been a significant decline in the demand for the type of software ByteRight has developed due to a shift in technology and consumer preferences.

- Internal Factors: ByteRight’s software is generating less revenue than initially projected, and there’s increased competition offering similar features at lower prices.

- Cash Flow Projections: Future cash flows from the software, discounted back to their present value, are estimated to be ₹35 million.

- Fair Value Assessment: An independent valuation assesses the software’s fair value less costs to sell at ₹30 million.

In this situation, the recoverable amount is the higher of the value in use (₹35 million) and fair value less costs to sell (₹30 million). Therefore, the recoverable amount is ₹35 million.

Since the carrying amount of the asset (₹50 million) exceeds the recoverable amount (₹35 million), an impairment loss of ₹15 million is recognized. This loss will reduce the carrying amount of the software to its recoverable amount and will be recorded in ByteRight’s statement of profit or loss, reflecting the diminished prospects of the software generating future economic benefits.

Intangible Assets- Derecognition

- Consider Derecognition (D) when:

- Asset Disposal (DS): If the intangible asset is sold or disposed of, it is derecognized. This means the asset is removed from the balance sheet.

- End of Useful Life/Contract (EC): If the intangible asset has reached the end of its useful life or the end of a contractual term, it is also derecognized.

2. Disposal or Retirement (DS):

- Remove from Balance Sheet: When the asset is disposed of or retired, its value is removed from the balance sheet. This step is the actual derecognition event for disposal or retirement.

3. End of Contract (EC):

- Remove from Balance Sheet: Similarly, if the asset’s useful life is over or a contract has ended, it is removed from the balance sheet, reflecting that the asset is no longer expected to bring future economic benefits.

Example: Derecognition of a Software License

Suppose InfoEdge Tech Co., an IT firm, has a licensed software product on its books, recorded as an intangible asset with a carrying amount of ₹20 million. The company has decided to pivot to a new technology, rendering the licensed software obsolete.

Here’s how InfoEdge might approach derecognition:

- Decision to Sell: InfoEdge decides to sell the license to another company willing to continue using the older technology.

- Sale Agreement: After negotiations, the license is sold for ₹5 million.

- Accounting for Derecognition: The carrying amount of the software license (₹20 million) is removed from the company’s books.

- Recognition of Loss: A loss on disposal of ₹15 million (₹20 million carrying amount minus ₹5 million sale price) is recognized in InfoEdge’s statement of profit or loss.

Accounting Entries at Derecognition:

- Debit Cash/Bank ₹5 million (to record the cash received).

- Debit Loss on Disposal of Intangible Asset ₹15 million (to record the loss on derecognition).

- Credit Intangible Assets ₹20 million (to derecognize the asset from the balance sheet).

The result is that the asset and the associated economic benefits or potential service capacity of the intangible asset are removed from the company’s financial statements. This action reflects the fact that InfoEdge will no longer receive any future economic benefits from the software license.

Conclusion

Intangible assets are vital to many modern businesses, and IAS 38 provides a robust framework for recognizing and measuring these valuable resources. Understanding and applying these principles is critical to reflecting the true value and potential of an entity’s intangible assets.

Final Thoughts for Engineers

For engineers working in sectors with significant intangible assets, such as software development or biotechnology, it’s essential to comprehend how these assets are accounted for. Recognizing the value of patents, proprietary technology, and R&D efforts in financial terms is crucial for innovation-driven companies, influencing investment decisions and company valuation.

Further Learning Resources: Accounting for R&D in the EV Sector Under IAS 38