The Indian electric vehicle (EV) industry is on the cusp of a transformation, with three-wheelers leading the charge towards a greener future. However, navigating the financial landscapes of this burgeoning market requires more than just innovative technology; it demands strategic foresight and adept financial planning. In this context, understanding and mastering the art of creating strategic provisions and financial forecasts becomes indispensable for businesses aiming for sustainability and growth.

Measurement of provisions is a critical aspect of accounting, especially for industries with significant future obligations like the electric vehicle (EV) industry. Let’s dive into the concept with examples:

Examples from the Indian Scenario

Let’s consider two hypothetical examples to illustrate the application of provisions and financial forecasting:

- ElectraZoom, a Pioneer in EV Three-Wheelers: ElectraZoom decides to offer a comprehensive 5-year warranty on its vehicles, anticipating a 3% failure rate based on industry standards. By calculating the expected cost of honoring these warranties, ElectraZoom sets aside a provision, ensuring that they’re financially prepared to meet their obligations without impacting their operational budget.

- GreenWheels, Embracing Sustainability: GreenWheels launches a project to establish battery recycling centers across India. To account for the future costs associated with this initiative, GreenWheels creates a provision for environmental restoration, aligning with their sustainability goals and regulatory requirements.

Estimation in Measurement of Provisions

When we talk about measuring provisions, it means assigning a monetary value to the future obligations of a company. This requires careful estimation and sometimes discounting to present value if the time value of money is significant.

Time Value of Money

The time value of money is a principle that suggests money available now is worth more than the same amount in the future due to its potential earning capacity. This core principle of finance holds that, provided money can earn interest, any amount of money is worth more the sooner it is received.

Large Population of Items

For provisions involving many items, like warranties for a fleet of EVs, the measurement would be based on the expected cost to settle the warranty claims. For example, if an EV manufacturer sells 1,000 vehicles and expects a 2% defect rate, with each repair costing ₹50,000, the provision would be:

1,000 vehicles x 2% defect rate x ₹50,000 repair cost = ₹1,000,000 provision for warranty obligations.

Single Obligation

If we consider a single obligation, such as an environmental rehabilitation provision for a single EV battery disposal site, the cost would be based on the best estimate of the expenditure required to settle the present obligation at the reporting date.

For instance, if the estimated cost to rehabilitate a site is ₹10 million and the work will commence in five years, this amount would need to be discounted to its present value using a discount rate that reflects current market assessments and the time value of money.

Discounting to Present Value

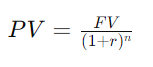

The discounting to present value becomes necessary when the provision involves a long-term obligation. Suppose the above ₹10 million rehabilitation cost needs to be settled after five years, and the current discount rate is 5%. The present value of the provision would be calculated using the formula for the present value of a future sum of money.

The present value (PV) of a future sum of money is calculated using the formula:

Where:

- ( PV ) is the present value

- ( FV ) is the future value of the money

- ( r ) is the discount rate or interest rate per period

- ( n ) is the number of periods until the payment or cash flow occurs

This formula is based on the concept of the time value of money, which posits that a sum of money today is worth more than the same sum in the future due to its potential earning capacity. The discount rate reflects the rate of return that could be earned on an investment in the present. The formula discounts the future value back to the present value.

Probable Outflow of Economic Benefit

A provision should only be recognized if there is a probable outflow of economic benefits to settle the obligation. ‘Probable’ here means that the outflow is more likely than not to occur.

Examples

- Warranty Obligations (Large Population): ElectraDrive Inc. offers a warranty on the batteries for its EVs. Based on past experience, they expect a 1% failure rate on their 10,000 batteries sold, each costing ₹30,000 to replace. The provision for warranty obligations would be 10,000 x 1% x ₹30,000 = ₹3,000,000.

- Environmental Rehabilitation (Single Obligation): If GreenWheels EV has to clean up a polluted manufacturing site and the estimated future cost is ₹50 million payable in 10 years, and the discount rate is 6%, the present value of this obligation would be calculated and recognized as a provision.

- Decommissioning Costs (Time Value of Money): For instance, FutureMove EV needs to dismantle a production facility in 15 years, with an expected cost of ₹100 million. Using a discount rate, the present value would be much less than ₹100 million and is what would be recognized as a provision.

The measurement of provisions is subject to estimation and involves a significant degree of judgment. It requires careful consideration of the specifics of each obligation and the economic environment. In the EV industry, where technology and regulations are rapidly evolving, the accurate measurement of provisions becomes even more challenging but critical for reflecting true financial health.

Accounting for provisions

Accounting for provisions involves recognizing a liability and an expense in the financial statements. Here’s a simplified explanation of the accounting entry:

When a provision is recognized, the entity must record an expense in the income statement and a liability in the balance sheet. The entry would look like this:

Journal Entry to Record a Provision:

| Date | Account Titles and Explanation | Debit (₹) | Credit (₹) |

|---|---|---|---|

| DD/MM/YYYY | Provision Expense (Income Statement) | X | |

| DD/MM/YYYY | Provision for [Specific Obligation] (Balance Sheet) | X |

Here’s a step-by-step breakdown:

- Debit the Provision Expense:

- This reflects the cost that the business expects to incur and is reported on the income statement. It reduces the net income for the period in which the provision is recognized.

- Credit the Provision Liability:

- This creates a liability on the balance sheet. It represents an obligation to pay in the future.

The amount “X” will be the estimate of the obligation.

Example of a Warranty Provision Entry:

Let’s say an EV manufacturer, EV Pro Motors, needs to create a warranty provision for potential future repairs. Based on their estimates, they expect that repairs over the next year will cost ₹10,000,000.

| Date | Account Titles and Explanation | Debit (₹) | Credit (₹) |

|---|---|---|---|

| DD/MM/YYYY | Warranty Expense | 10,000,000 | |

| DD/MM/YYYY | Provision for Warranty Obligations | 10,000,000 |

At the end of the fiscal year, EV Pro Motors would include these entries in their accounts. The ₹10,000,000 expense will reduce their profit in the income statement, and the liability of the same amount will be recognized on the balance sheet.

As actual costs to settle the provision are incurred, the company will then reduce the provision and recognize the actual cost. For example, if they spend ₹1,000,000 on warranty repairs during the year, the entry to record this would be:

| Date | Account Titles and Explanation | Debit (₹) | Credit (₹) |

|---|---|---|---|

| DD/MM/YYYY | Provision for Warranty Obligations | 1,000,000 | |

| DD/MM/YYYY | Cash/Bank | 1,000,000 |

This entry reduces the provision liability on the balance sheet and the cash or bank balance as the company pays for the repairs.

Understanding and recording provisions accurately is crucial as it ensures that the financial statements reflect all current obligations, even if the exact amount or timing is uncertain. This principle follows the accounting concept of prudence, recognizing expenses and liabilities as soon as a reasonable estimate can be made./

Conclusion

In the dynamic landscape of India’s EV three-wheeler market, strategic provisions and adept financial forecasting are not just accounting exercises; they are essential strategies for navigating uncertainties and seizing opportunities. By accurately estimating future obligations and effectively planning for financial sustainability, companies can drive innovation, foster consumer trust, and contribute to a cleaner, greener future.

As we accelerate towards an electrified transportation era, the companies that master these financial disciplines will not only lead the market but also shape the future of mobility in India.