The financial landscape is riddled with complexities, particularly when it comes to setting aside funds for future events or obligations. Provisions are a critical aspect of this landscape, yet not all future costs warrant the creation of a provision. Understanding the specifics, from future operating losses to onerous contracts and restructuring, can help businesses navigate these murky waters more effectively.

Future Operating Losses: A Clear Stance

A common misconception in financial planning is the idea of making provisions for future operating losses. However, according to accounting standards, provisions for future operating losses are not allowed. The rationale is straightforward: such losses are speculative and pertain to future events that have not yet occurred and may not occur as anticipated. Making provisions for these would not only undermine the principle of prudence but also distort the financial health of a company.

Onerous Contracts: Understanding the Burden

The term “onerous” finds its roots in the Latin word “onus,” which means burden. In the context of contracts, an onerous contract is one where the unavoidable costs of meeting the obligations exceed the economic benefits expected to be received. These contracts represent a present obligation that leads to an outflow of resources embodying economic benefits.

Example: An EV manufacturing company, EcoDrive, enters a long-term lease for a warehouse to store its inventory. Due to a sudden shift in market demand, the space is no longer needed, yet the lease payments continue to exceed the benefits. Here, EcoDrive would recognize a provision for the present obligation under the onerous contract, reflecting the net cost of fulfilling the contract.

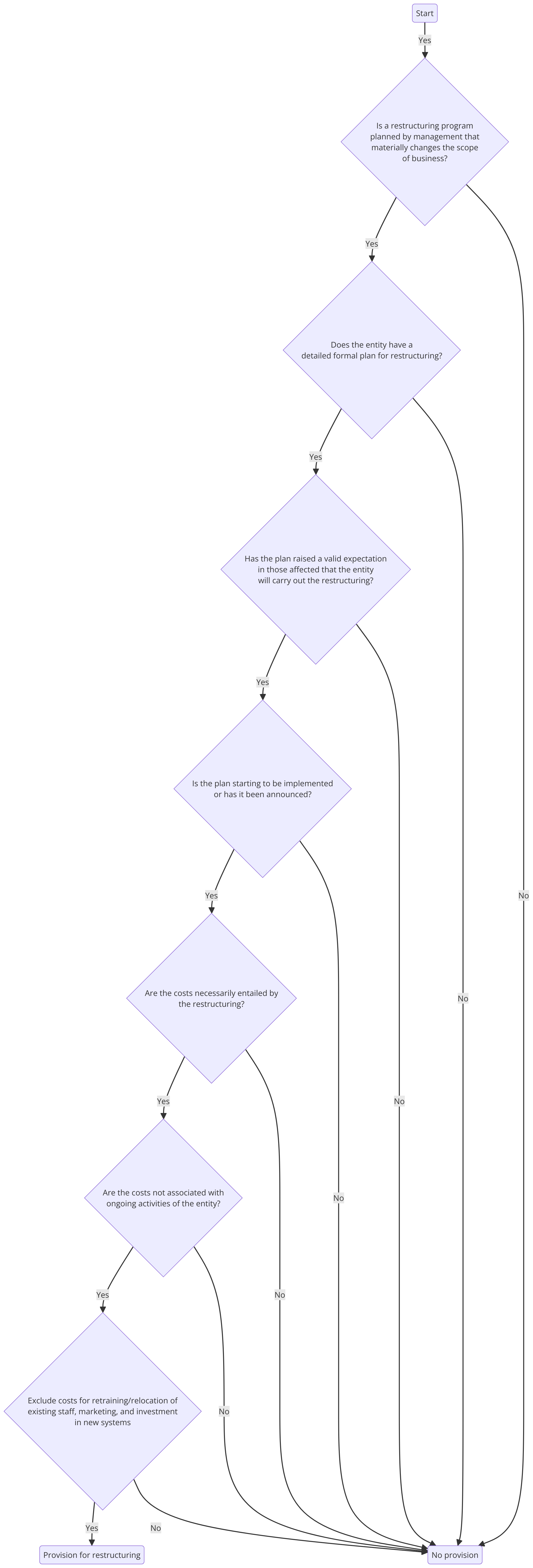

Provision for Restructuring

Restructuring provisions are recognized when an entity has a detailed formal plan for the restructuring, including the affected areas, locations, job classifications, approximate number of employees who will be compensated for terminating their services, and the implementation timeframe. The provision should only include direct expenditures arising from the restructuring, not future operating costs.

Example: Suppose ElectraWheels decides to streamline its operations by closing certain non-performing outlets. The costs involved in this, including severance payments and costs of closing the facilities, would be recognized as a provision for restructuring, given ElectraWheels has a detailed plan and a clear commitment to proceed.

Provisions for Dismantling/Decommissioning Costs

These provisions account for the future dismantling or decommissioning of assets and restoring the site on which they are located. The obligation typically arises when the asset is installed or used.

Example: GreenTech Power installs a new battery manufacturing plant with the condition that at the end of its life, the plant must be dismantled and the site restored. The estimated cost of this obligation is assessed at the time of the plant’s installation and is recognized as a provision, which is then discounted to its present value. This provision ensures that the financial impact of dismantling and restoration is accounted for throughout the asset’s life, aligning with the principle of matching costs with revenues.

Alright, let’s assume that the initial cost of setting up GreenTech Power’s battery manufacturing plant is (PPE) ₹100 million. The company expects that the plant will need to be dismantled and the site restored at the end of its 15-year life, with an estimated dismantling cost of ₹10 million payable at that time. Using a discount rate of 5%, we calculate the present value of the dismantling costs to recognize as a provision.

Initial Recognition (at the start of Year 1):

- The initial cost of PPE (plant and equipment) is ₹100 million.

- The present value of the dismantling cost of ₹10 million after 15 years at a 5% discount rate is approximately ₹3.84 million (this is the amount recognized as a provision).

Journal Entry in Year 1:

- Debit: Property, Plant, and Equipment (PPE) ₹103.84 million (₹100 million initial cost + ₹3.84 million dismantling cost added to asset cost)

- Credit: Provision for Dismantling Costs ₹3.84 million

Statement of Financial Position (SOFP) in Year 1:

- Non-current assets: PPE is reported at ₹103.84 million.

- Non-current liabilities: Provision for Dismantling Costs is reported at ₹3.84 million.

Yearly Unwinding of Discount (each Year till Year 15):

- Finance costs related to the unwinding of the discount are recognized in the SOPL and added to the provision annually.

Journal Entry each Year for Unwinding of Discount:

- Debit: Finance Cost (SOPL) ₹192,000 (5% of ₹3.84 million)

- Credit: Provision for Dismantling Costs (SOFP) ₹192,000

SOPL each Year:

- Finance costs: An additional expense of ₹192,000 due to the unwinding of the discount.

SOFP each Year:

- Non-current liabilities: The Provision for Dismantling Costs increases by ₹192,000.

At the End of Plant Life (end of Year 15):

- Assume the actual cost of dismantling matches the estimated cost of ₹10 million.

Journal Entry in Year 15:

- Debit: Provision for Dismantling Costs ₹10 million (to eliminate the liability)

- Credit: Cash/Bank ₹10 million (to reflect cash outflow for dismantling)

SOFP at the End of Year 15:

- Cash/Bank: Decreases by ₹10 million.

- Non-current liabilities: Provision for Dismantling Costs is reduced to zero.

Over the 15 years, GreenTech will also record depreciation for the plant. Assuming straight-line depreciation over 15 years for the initial cost (₹100 million), the annual depreciation would be approximately ₹6.67 million per year.

SOPL Annual Depreciation Entry:

- Debit: Depreciation Expense ₹6.67 million

- Credit: Accumulated Depreciation – PPE ₹6.67 million

By the end of the 15-year period, the PPE would be fully depreciated, and the accumulated depreciation would be ₹100 million, offsetting the initial cost of the asset.

Please note that these figures are for illustrative purposes and actual figures would depend on precise calculations of present values using financial formulas and considering any change in estimates over time.

Conclusion

Provisions play a crucial role in ensuring that businesses are financially prepared for future obligations. By distinguishing between situations that warrant provisions and those that do not, companies can maintain accuracy in their financial statements, ensuring they reflect a true and fair view of the company’s financial position. Understanding these distinctions is key to prudent financial planning and reporting, particularly in industries like EV manufacturing, where long-term obligations and contracts are commonplace.