The landscape of asset financing in the electric vehicle (EV) industry involves strategic decision-making, particularly when it comes to managing leases. Understanding the roles of the lessee and lessor, as well as the different types of leases, is crucial for companies operating in this space.

Who is the Lessee and the Lessor?

In lease agreements, the lessee is the party that obtains the right to use an asset for a predetermined period, while the lessor is the owner of the asset who grants this right. For instance, an EV manufacturing company may lease machinery (lessee) from a financing company (lessor) to augment its production capacity.

What is a Lease?

A lease is a contractual arrangement where the lessor allows the lessee to use an asset for a certain period in exchange for payent. Leases enable EV companies to use the latest technologies without the substantial upfront investment of purchasing.

Divergent Accounting for Lessor and Lessee:

Lessees record leased assets and corresponding liabilities on their balance sheets, while lessors continue to present the leased asset in their books, recognizing lease income over the lease term.

Understanding Right-of-Use Assets:

A right-of-use (ROU) asset arises from a lease agreement, representing the lessee’s right to use an underlying asset. An EV company, for example, would recognize an ROU asset for a leased factory where its vehicles are assembled.

Classification of Leases: Finance vs. Operating Leases:

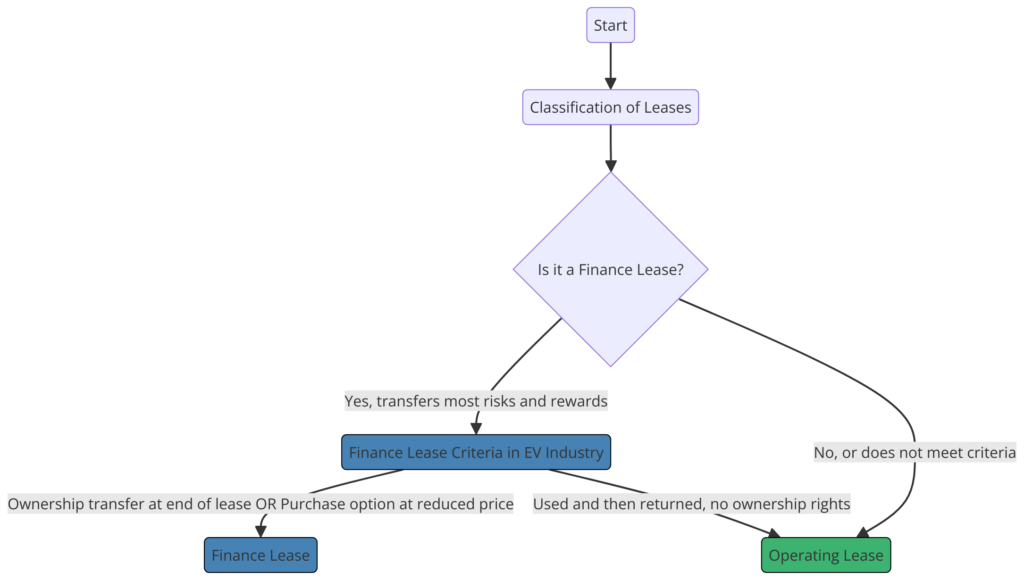

The classification into finance or operating leases depends on whether the lease substantially transfers all risks and rewards of ownership to the lessee. In a finance lease, an EV company recognizes the leased vehicle as an asset, implying it bears the associated risks and rewards. An operating lease, however, would be akin to a rental, without such transfer.

Above Diagram provide the logic to identify Finance Lease or Operating Lease.

Substance Over Form:

This principle dictates that the economic substance of a transaction takes precedence over its legal form. If an EV firm leases batteries with an option to purchase at the end of the term for a minimal amount, it’s likely a finance lease despite being called a lease agreement. For Example Redeemable Preference shares. The word / Name related to shares however the nature of transaction is different. That is Substance of transaction takes precedence over its legal form.

Convertible vs. Redeemable Preference Shares:

Convertible preference shares offer the option to convert into ordinary shares, while redeemable preference shares can be repurchased by the issuing company. In our EV context, convertible shares might allow investors to participate in the equity upside, whereas redeemable shares could be a financing strategy to manage cash flows and obligations.

Conclusion:

For EV companies, lease accounting is a nuanced field that requires careful analysis beyond the face value of contracts. By distinguishing between finance and operating leases and underst anding the concepts of substance over form, they can better align their accounting practices with the economic realities of their business operations.