In the realm of finance, the Internal Rate of Return (IRR) is a pivotal metric, especially when analyzing the viability of investments in redeemable bonds. This post delves into the essence of IRR, its significance in determining the cost of debt for redeemable bonds, and provides a step-by-step guide on calculating the IRR, illustrated with a practical example.

What is the Internal Rate of Return (IRR)?

The IRR is a discount rate that makes the net present value (NPV) of all cash flows from a particular project or investment equal to zero. In simpler terms, it’s the rate of growth an investment is expected to generate. Specifically, in the context of redeemable bonds, the IRR represents the cost of debt, offering a comprehensive look at the return provided by the bond’s cash flows.

Calculating the IRR: A Step-by-Step Guide

The process of determining the IRR involves a few critical steps, starting from identifying the cash flows associated with an investment to calculating the IRR itself. Here’s how it’s done:

Step 1: Identify the Cash Flow

This step involves outlining all incoming and outgoing cash flows expected from the investment. For redeemable bonds, this would include the purchase price, any coupon payments, and the redemption value at maturity.

Step 2: Calculate Two NPVs (One Negative and One Positive)

To find the IRR, you need two NPV calculations at different discount rates—one where the NPV turns out to be positive and another where it’s negative. This is because the IRR is located at a point where the NPV crosses zero.

Step 3: Calculate the IRR

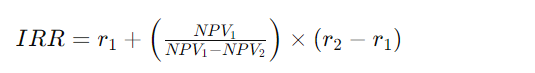

With two NPVs calculated—one positive and one negative—you can interpolate to find the IRR. The formula for interpolation is as follows:

Where:

- (r_1) is the lower discount rate,

- (r_2) is the higher discount rate,

- (NPV_1) is the NPV at (r_1), and

- (NPV_2) is the NPV at (r_2).

Learn More: Mastering IAS 21: The Impact of Foreign Exchange Rate Changes

Example: Calculating the IRR for a Redeemable Bond

Imagine “EcoBike Bonds,” issued by an electric bicycle company, with a purchase price of INR 1,000, a 5-year maturity, annual coupon payments of INR 100, and a redemption value of INR 1,100.

Step 1: The cash flows are:

- Year 0 (now): -INR 1,000 (purchase price)

- Years 1-5: INR 100 (annual coupon payment)

- Year 5: INR 1,100 (redemption value)

Step 2: Let’s assume at a 5% discount rate, the NPV is positive, and at a 10% discount rate, the NPV is negative. (For simplicity, exact NPV calculations are not shown here.)

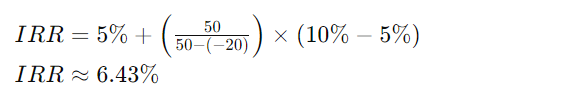

Step 3: Suppose the NPV at 5% is INR 50 (positive), and at 10%, it’s -INR 20 (negative). Plugging these into our interpolation formula gives us:

Therefore, the IRR, or the cost of debt for “EcoBike Bonds,” is approximately 6.43%.

Conclusion

Understanding the IRR is crucial for investors and financial analysts, especially when evaluating the cost of debt for redeemable bonds. By following the steps outlined above, one can efficiently calculate the IRR, providing valuable insights into the potential returns from an investment. This method not only aids in making informed investment decisions but also in strategizing financial planning within sectors like the electric vehicle industry, where redeemable bonds can play a significant role in financing growth and innovation.