The world of finance is intrinsically linked to the dynamics of foreign exchange rates. International businesses, in particular, must navigate the volatility of currency fluctuations, which can significantly affect their financial reporting. IAS 21, “The Effects of Changes in Foreign Exchange Rates,” provides a framework for dealing with foreign currency transactions and reporting the effects of rate changes. Here’s a closer look at the key aspects of this standard and its implications for financial statements.

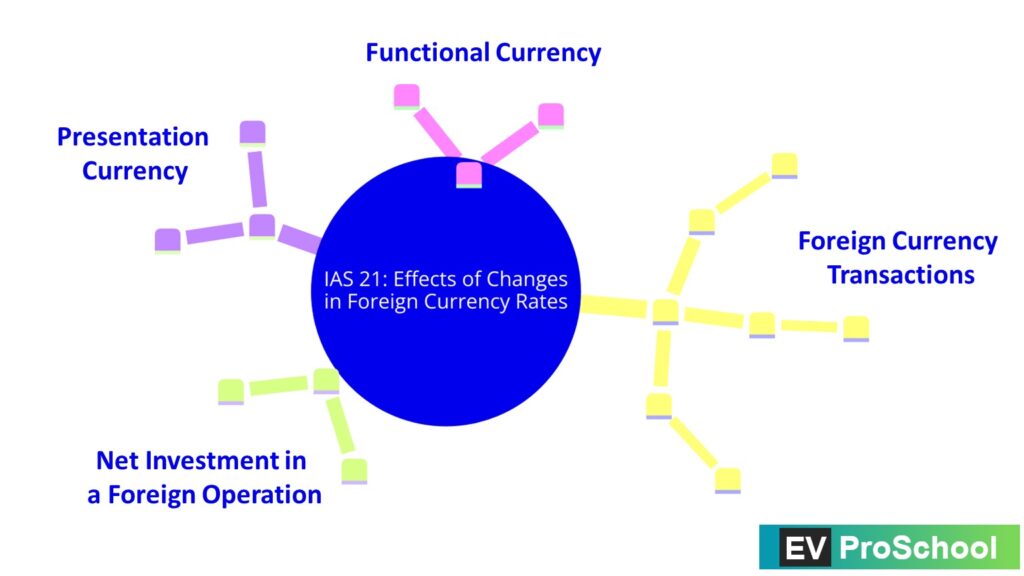

Understanding IAS 21

IAS 21 establishes the guidelines for reporting transactions in foreign currencies and the translation of financial statements from a foreign operation into the reporting currency. The standard ensures consistency and comparability by setting out how to convert and report transactions in the entity’s functional currency and how to translate financial statements into a presentation currency.

Functional and Presentation Currency

Functional Currency:

Functional currency is the currency of the primary economic environment in which the entity operates. It’s the currency of the cash flows that indicate the financial health of the business.

How a Company can determine its Functional Currency?

This currency:

- Is often the one in which cash is mainly generated and expended.

- Influences the pricing of goods and services.

- Is affected by the competitive forces and regulations of the country which determine the sales prices of goods and services.

- Has an impact on the labor, material, and other costs associated with providing goods or services.

- Is the currency in which funds from issuing debt and equity are generated.

- Is the one in which receipts from operating activities are retained.

By analyzing these factors, an entity can determine its functional currency, thereby ensuring consistency and relevance in its financial statements.

Presentation Currency

is the currency in which the financial statements are presented. An entity can present its financial statements in any currency (or currencies). If the presentation currency differs from the functional currency, it requires the financial statements to be translated.

Read More: How to Distinguish between Equity & Debt? Substance Over Form

Foreign Currency Transactions

In the rapidly evolving Electric Vehicle (EV) sector, foreign currency transactions are integral to business operations, given the global nature of the industry. EV companies often engage in such transactions for various strategic and operational reasons:

- Acquiring Raw Materials: Many specialized components used in EV manufacturing, like lithium for batteries or rare earth metals for motors, are sourced internationally. Transactions to secure these materials frequently require settlement in the supplier’s local currency.

- Purchasing Machinery: The cutting-edge technology used in EV production often means purchasing machinery and robotics from overseas, involving transactions in foreign currencies to acquire the best-in-class equipment.

- Foreign Loans: To capitalize on lower interest rates or favorable borrowing terms, EV companies might procure loans in foreign currencies. This can also act as a natural hedge if the company has revenues in that currency.

- Exports: With the push for a greener future, the demand for EVs is on the rise globally. EV manufacturers may export vehicles to various countries, necessitating transactions in the currencies of those markets to facilitate sales and distribution.

Each of these transactions requires careful management to mitigate the risks associated with foreign exchange rate fluctuations. Companies must employ robust hedging strategies and keep abreast of currency trends to protect profit margins and ensure financial stability.

Accounting Treatment:

A foreign currency transaction is any operation that involves a currency different from the entity’s functional currency. According to IAS 21, these transactions should be initially recorded at the spot exchange rate between the functional currency and the foreign currency at the date of the transaction.

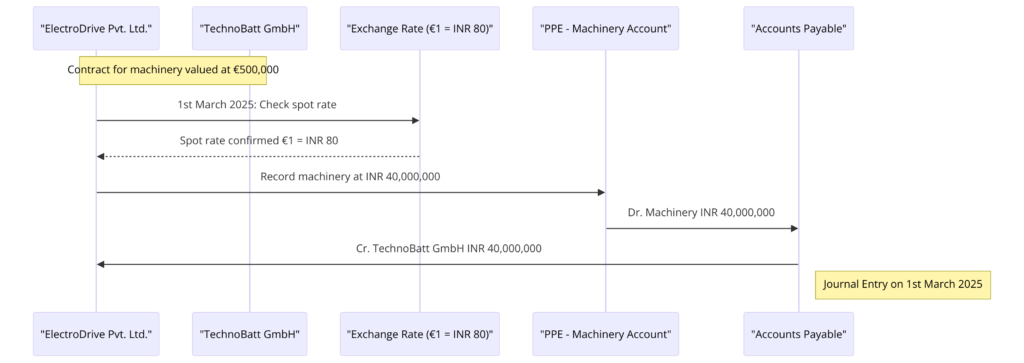

Step 1: Initial Recognition & measurement:

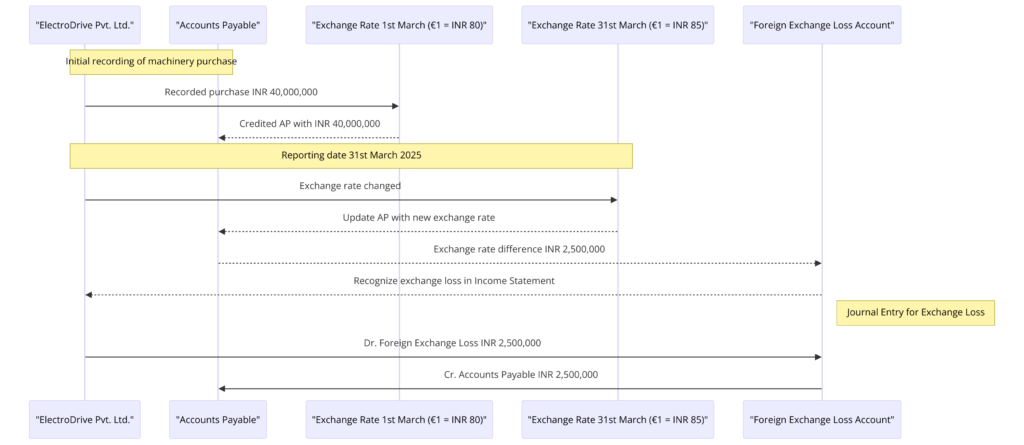

Let’s consider an Indian EV company, ElectroDrive Pvt. Ltd., which has decided to purchase advanced battery manufacturing machinery from a German supplier, TechnoBatt GmbH. The contract is valued at €500,000, and the transaction will be completed in euros.

Initial Recognition:

At the date of the transaction, say 1st March 2025, ElectroDrive Pvt. Ltd. would record the purchase in its books in Indian rupees (INR), using the spot exchange rate on that day. Let’s assume the spot exchange rate is €1 = INR 80.

Initial Measurement:

The initial amount recognized in the Indian company’s financial records would be:

- Amount in Foreign Currency (FC): €500,000

- Spot Exchange Rate (ER) on 1st March 2025: €1 = INR 80

- Initial Recognition in Home Currency (HC): €500,000 * INR 80 = INR 40,000,000

So, ElectroDrive Pvt. Ltd. would recognize the machinery at an initial value of INR 40,000,000 in its financial statements on 1st March 2025.

Journal Entry on 1st March 2025 would be:

- Dr. Property, Plant, and Equipment (PPE) – Machinery: INR 40,000,000

- Cr. Accounts Payable (AP) – TechnoBatt GmbH: INR 40,000,000

This entry records the machinery’s value and the obligation to pay the supplier in INR terms, using the exchange rate on the initial recognition date. It is important to note that any subsequent changes in the exchange rate will require additional accounting adjustments, either as transaction gains or losses recognized in profit or loss, or as adjustments to the carrying amount of the machinery if the payment is deferred and the currency fluctuation is significant.

Step 2: Subsequent Measurement at each balance sheet date:

- Foreign currency monetary amounts should be reported using the closing rate.

- Non-monetary items carried at historical cost should be reported using the exchange rate at the date of the transaction.

- Non-monetary items carried at fair value should be reported at the rates that were in effect when the fair values were determined.

For reporting at the ends of subsequent reporting periods under IAS 21, we have to translate foreign currency items using different exchange rates depending on their nature.

Example for ElectroDrive Pvt. Ltd.:

Consider ElectroDrive Pvt. Ltd. had recorded the purchase of machinery at INR 40,000,000 on 1st March 2025 based on an exchange rate of €1 = INR 80. Now, let’s say the reporting date is 31st March 2025 and the exchange rate has changed to €1 = INR 85.

Foreign currency monetary items (e.g., Accounts Payable for machinery purchase):

- Original Value in INR: 40,000,000

- New Exchange Rate: INR 85

- Revised Value in INR: €500,000 * INR 85 = INR 42,500,000

- Exchange Gain/Loss: INR 42,500,000 – INR 40,000,000 = INR 2,500,000 (Loss if the liability is still outstanding, as it will cost more INR to settle the same € amount)

Journal Entry for Exchange Loss:

- Dr. Foreign Exchange Loss (Income Statement): INR 2,500,000

- Cr. Accounts Payable (Balance Sheet): INR 2,500,000

This reflects the loss due to an increase in the settlement amount of the liability due to the adverse movement of the exchange rate.

Non-monetary items (e.g., Prepaid expenses or Inventory purchased):

- These are not retranslated at the closing rate since they are carried at historical cost.

Non-monetary items measured at fair value:

- These would be translated using the exchange rates at the date when the fair value was measured. This is usually applied when fair value measurements are done periodically, such as annual revaluations of property, plant, and equipment.

In the example of ElectroDrive Pvt. Ltd., if the machinery was a non-monetary item and it was initially measured at fair value in euros and later its fair value was reassessed at the reporting date, the translation would be done using the exchange rate applicable on the date of that fair value measurement.

Translation to Presentation Currency

The financial statements of a foreign operation should be translated to the entity’s presentation currency using the following rules:

- Assets and Liabilities are translated at the closing rate at the date of that balance sheet.

- Income and Expenses are translated at exchange rates at the dates of the transactions (or a weighted average if it’s impractical to use the exact rates).

- Equity items other than profit or loss are translated using historical rates.

- Any translation differences should be recognized in other comprehensive income (OCI) and accumulated in a separate component of equity until the disposal of the foreign operation.

Implications and Challenges

The fluctuations in exchange rates can have various implications on financial reporting. Revenue and expenses might appear higher or lower depending on the currency’s strength or weakness. The same goes for assets and liabilities when translated to a different currency. These effects can be especially pronounced during periods of significant currency volatility.

For businesses, understanding and implementing IAS 21 is critical. It not only helps in complying with financial reporting requirements but also in managing foreign exchange risks. Companies must ensure that they have robust systems in place to capture the necessary data for accurate translation and that their finance teams are equipped to handle the complexities of foreign exchange rates.

Conclusion

IAS 21 provides a consistent approach to foreign currency translation, allowing businesses and their stakeholders to better assess the international aspects of operations. By understanding the effects of exchange rate changes, entities can more accurately present their financial health and make more informed decisions.