Navigating the world of finance can be akin to driving through uncharted territory. For companies in the electric vehicle (EV) sector, investing and managing finances require a robust understanding of financial asset classification. Let’s demystify this with a focus on the Contractual Cash Flow Test (CCFT) and the classification of financial assets into debt and equity.

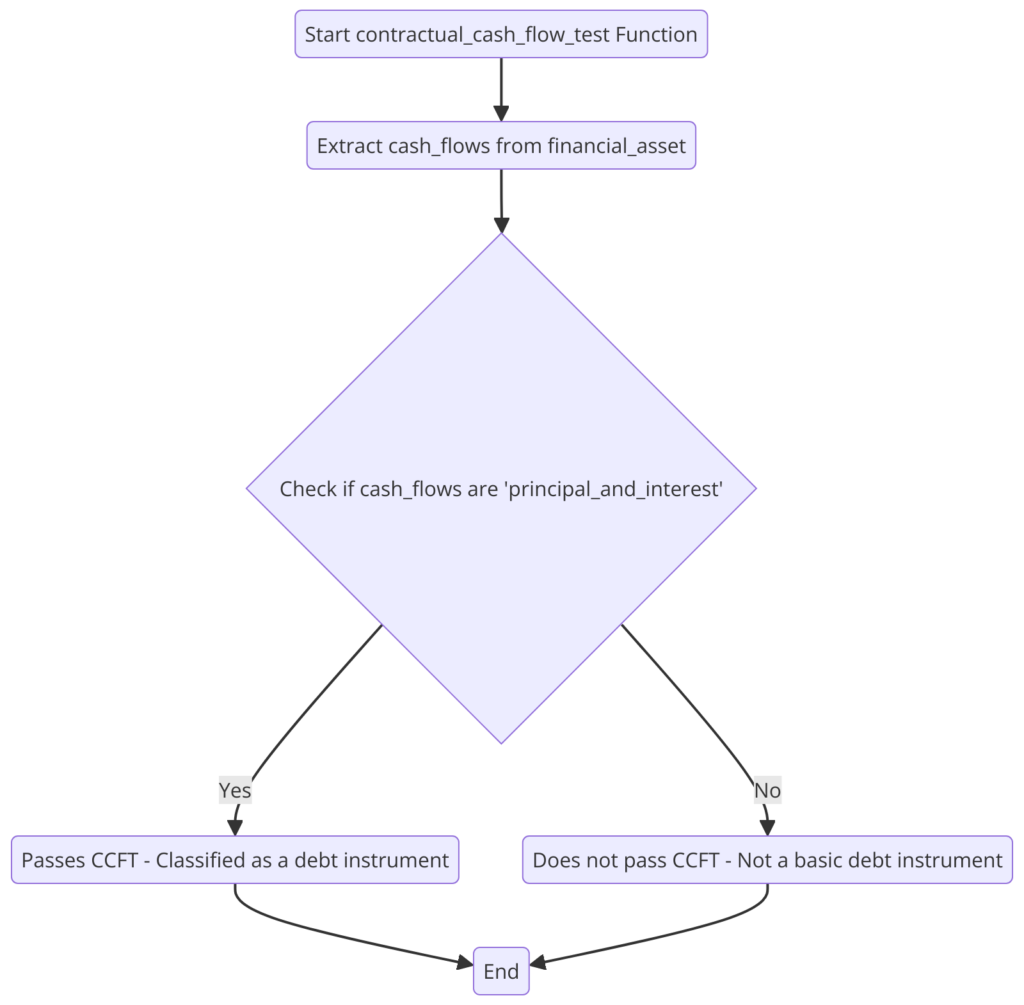

What is the Contractual Cash Flow Test (CCFT)?

Imagine signing a contract where you agree to loan money and, in return, receive a series of payments. These payments typically consist of the initial amount you loaned (the principal) plus interest. The CCFT is a check to ensure that the cash flows from a financial asset are strictly from these two sources – if they are, then the asset is likely a debt instrument. It’s called a “contractual” test because it’s based on the explicit terms written in the contract.

Why Debt and Equity Classifications?

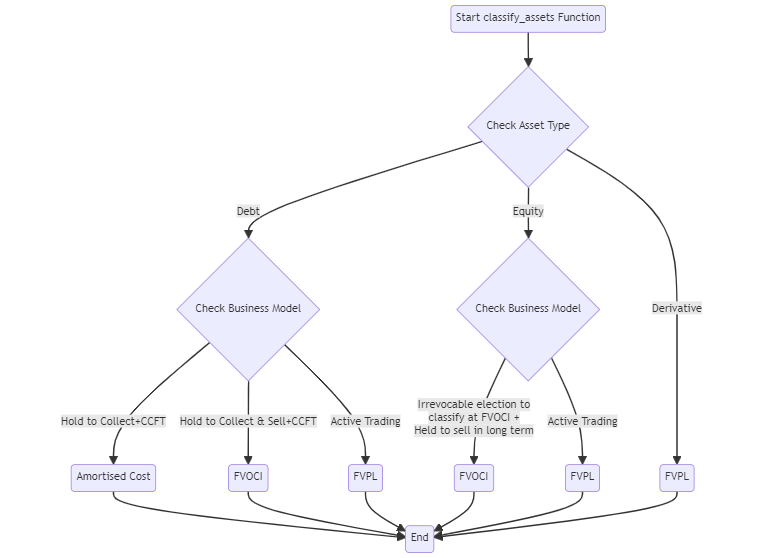

In the financial world, we can think of assets in two main categories:

- Debt: This is like lending your friend money. You expect to get back the same amount with some interest – it’s predictable. In finance, this can lead to classifications like Amortised Cost or FVOCI if you plan to hold these investments for a while.

- Equity: This is like owning a part of a business. Instead of a predictable return, you get dividends which can vary and are not guaranteed. The value of your ownership can go up or down, so it’s typically classified at FVOCI (if you’re holding onto it for the long term) or FVPL (if you’re looking to make a quick profit from price changes).

Classification Based on CCFT and the Business Model Test

For classification, we first use the CCFT. If an asset passes this test, it’s likely a debt instrument. But to know where exactly to place it – Amortised Cost, FVOCI, or FVPL – we look at the company’s business model. Do they intend to sell these assets, or hold them for cash flow?

Equity Classification in Detail

Equity investments are usually subject to FVOCI or FVPL because they don’t have the predictable cash flows of debt instruments. However, for FVOCI, there’s a catch – once you classify an equity investment here, you can’t change your mind; it’s an irrevocable election.

Derivatives and FVPL.

Derivatives are financial contracts whose value is derived from an underlying asset. They’re always at FVPL because their value can change rapidly – they’re the sports cars of the financial world, not your steady, reliable family sedan.

Writing the Financial Asset Classification Story

When a company like “EcoDrive Motors” classifies its financial assets, it tells a story about its intentions and how it expects these investments to perform. Are they a steady source of income (debt), or part of a strategy to drive growth through equity ownership? Or maybe they’re engaging in quick, strategic moves with derivatives? Each choice shapes the financial landscape of EcoDrive Motors and dictates how these assets are reported, much like choosing the right vehicle for the road ahead.

Let’s Apply This to EcoDrive:

- Amortised Cost Example: EcoDrive lends $1 million to a startup that is building charging stations. They expect to get this money back plus 5% interest every year until the loan is paid off.

- FVOCI Example: EcoDrive buys $500,000 in bonds from another EV company that they might sell in a few years. They don’t get immediate profit from value changes, but they will when they sell.

- FVPL Example: EcoDrive invests $200,000 in stock market trading to capitalize on short-term price movements. Profit or loss from this trading gets reported right away.

Each investment decision reflects EcoDrive’s business strategy and how they intend to manage their financial assets, which in turn dictates how these assets are classified and reported in their financial statements

Conclusion

Financial asset classification isn’t just about where to place investments on a spreadsheet. It’s a reflection of a company’s strategy and risk profile, especially in a sector as dynamic as the EV industry. By understanding these classifications, stakeholders can better gauge a company’s financial health and drive towards a more electrified future.

Now, let’s create an image that encapsulates the classification of financial assets in the context of the electric vehicle industry.