When EV companies consider raising funds through share issues, an array of financial experts becomes integral to the process. These Financial Advisors ensure that the complex journey of a share issue navigates through regulatory compliances, market dynamics, and investor expectations successfully.

The electric vehicle (EV) sector is electrifying the investment landscape. The appeal of EV stocks is undeniable. The market is projected to experience phenomenal growth, with estimations suggesting a global market size of over $8 trillion by 2030.

This blogpost will help you to Navigate in the share market. This dynamic sector requires a keen eye and a steady hand, especially for those venturing in for the first time

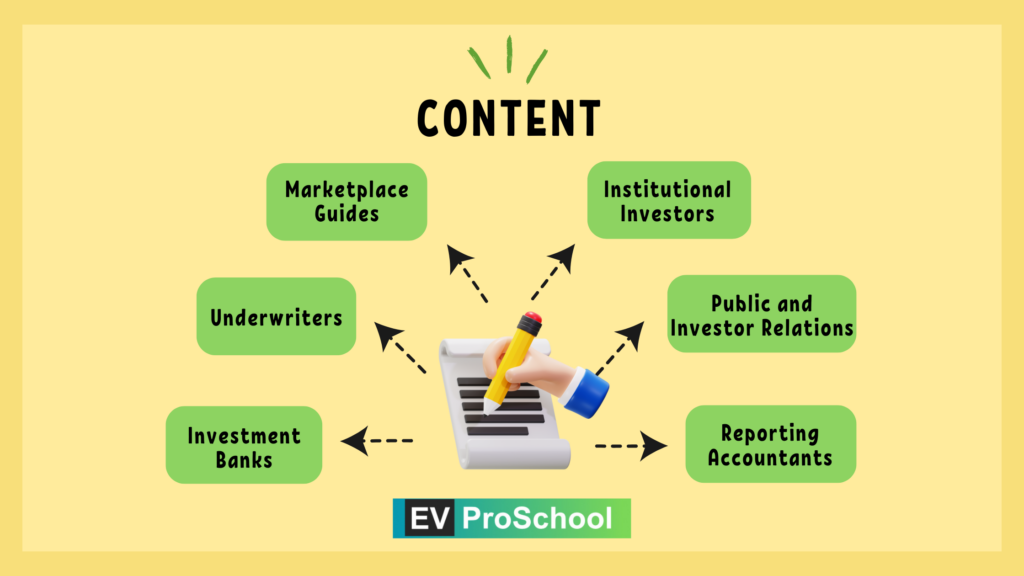

1. Investment Banks

Investment banks are the linchpins in the share issuance process. They advise EV companies on the intricate requirements of stock exchanges, helping them to prepare necessary documentation and comply with regulatory standards. These institutions guide companies on the types of shares to issue — be it ordinary, preference, or convertible — based on the company’s capital needs and the investors’ preferences. They also play a pivotal role in setting the issue price, underwriting the shares, and managing the publication of the issue.

2. The Safety Net: Underwriters

In cases where shares are not fully subscribed by the public, underwriters step in to absorb the surplus. These financial institutions, often investment banks themselves, shoulder the risk associated with new share issues. They promote these shares to third-party investors and, in doing so, retain a portion of the proceeds as a fee for the risk they undertake.

3. The Marketplace Guides: Stockbrokers

Stockbrokers act as navigators for smaller EV companies in the vast ocean of the capital market. While investment banks cater to larger entities, stockbrokers provide tailored services for smaller firms, assisting them in finding suitable investors and facilitating the share issue process.

4. The Heavy Hitters: Institutional Investors

Institutional investors such as mutual funds, represented by giants like LIC and other financing companies, are crucial players. They invest in bulk, bringing substantial capital to the table. Their participation not only provides the necessary funding but also instills confidence in other investors regarding the viability of the EV company’s prospects.

5. The Organizers: Registrars to an Issue

Registrars maintain the administrative backbone of a share issue. They handle the processing of applications, monitor payments, and provide essential advice on share issues to stock exchanges, investors, and the companies issuing the shares.

6. The Communicators: Public and Investor Relations

The public and investor relations teams play a dual role in managing communications and the administrative aspects of the share issue. They ensure that investors are kept informed and that the transactions between the company, investors, and the stock exchange are processed smoothly.

7. Reporting Accountants

Reporting accountants scrutinize the financial implications of a share issue. They provide insights into how the share issue might affect the company’s financial statements and the wider economic decisions of the financial statement users. This role is vital in understanding the long-term impact of share issues, including the effects on loan covenants and financial health.

Explore More : Methods for Issuing New Shares in EV Industry

How Financial Advisors Guide You

Financial advisors, with their expertise in financial planning and investment analysis, can be invaluable assets for navigating the complexities of EV stocks. Here’s how they can assist you:

- Identifying Investment Goals: A good financial advisor starts by understanding your investment goals, risk tolerance, and investment horizon. They can then tailor a strategy that aligns your EV investment with your overall financial plan.

- Fundamental Analysis: Advisors delve into the financial health of potential EV companies. They analyze factors like production capacity, technological advancements, market share, and the experience of the management team. This helps you understand the company’s true potential and make informed decisions.

- Technical Analysis: Financial advisors can use technical analysis tools to understand price trends and identify potential entry and exit points for your investment. This can help you potentially maximize returns and minimize losses.

- Portfolio Diversification: Advisors emphasize the importance of diversification. They can recommend a mix of EV stocks with established players in different segments (e.g., battery technology, charging infrastructure) to mitigate risk.

- Staying Informed: The EV market is constantly evolving. A financial advisor keeps you updated on the latest industry trends, government policies, and company news that may impact your investments.

Conclusion

The tapestry of financial advisors is critical for the successful issuance of shares by EV companies in India. As the EV industry grows, fueled by innovation and a shift towards sustainability, the role of these advisors will become increasingly significant. They not only guide companies through the complexities of the capital market but also ensure that the financial decisions made today will support the sustainable growth of the EV sector in the long run.