The journey towards listing on a stock exchange is a pivotal moment for electric vehicle (EV) companies, marking a transition from private to public markets. This move can significantly influence a company’s valuation, liquidity, and overall market perception. However, it’s a path lined with both golden opportunities and considerable challenges, particularly for entities at the intersection of innovation and environmental sustainability.

India’s first Electric Vehicle Index

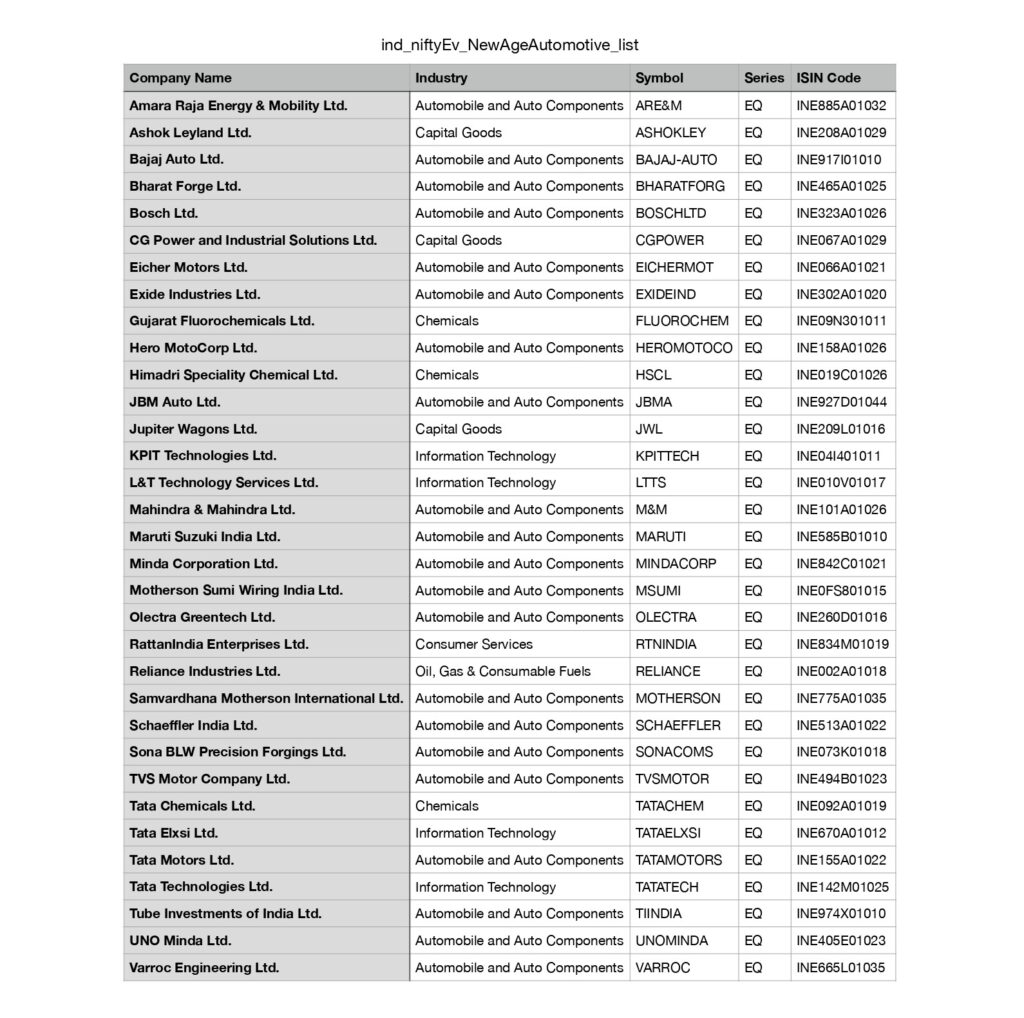

The National Stock Exchange has launched India’s first electric vehicle index. The newly launched Nifty EV & New Age Automotive index will track the performance of companies within the electric vehicle sector and those pioneering new-age automotive technologies.

The index includes established automakers and emerging EV startups, providing exposure to the rapidly evolving EV and automotive technology landscape.

Investing in this index or individual stocks within it could offer long-term growth potential, as the EV market is expected to witness significant expansion in the coming years, driven by factors like government policies, technological advancements, and changing consumer preferences.

EV Market Growth

The index has the potential to serve as a benchmark for asset managers and may become a reference index for passive funds, including ETFs, index funds, and structured products. For those unfamiliar with passive funds, ETFs, and index funds, further details are provided below; others may skip this section.

Explore More: The Capital Market in India for Electric Vehicles

1. What is Passive Funds?

Passive funds have seen a lot of interest in the last few months. But as an investor should you go for them or stick to active equity funds? Watch this video to find out!

A type of passive fund, ETFs also track indices but trade on stock exchanges like individual stocks. This gives investors the flexibility to buy and sell throughout the day, offering more liquidity compared to traditional mutual funds.

2. What are Index Funds / ETFs?

There are now over 6,000 ETFs on 60 exchanges and ETFs exist for everything from corporate bonds to gold bars to oil futures. Like the USB port or astock gas pump, ETFs have basically standardized the entire universe of investing so that everything under the sun now trades like shares of Apple. But what, exactly is an ETF and why have they become so popular?

Advantages of Stock Exchange Listing

1. Accurate Valuation:

Public listing offers an EV company a market-determined valuation, reflecting real-time investor confidence and market dynamics. This accurate valuation is crucial for EV companies, whose innovative technologies and growth prospects can sometimes be undervalued in private markets.

2. Enhanced Liquidity:

Listing on a stock exchange significantly increases a company’s liquidity, making buying and selling shares easier. For EV companies, this liquidity attracts more investors and facilitates quicker and more efficient capital raising to fund new technologies and expansion plans.

3. Elevated Profile and Credibility:

A public listing raises a company’s profile, enhancing its visibility among consumers, investors, and partners. This increased visibility can drive sales and, by extension, revenue. Moreover, the perceived credibility with vendors and financial providers can lead to better terms and access to more substantial financial resources.

4. Access to Future Investments:

Being publicly listed opens doors to additional capital-raising opportunities, such as follow-on public offerings or convertible bonds. For EV companies, where significant capital is required for research, development, and scaling operations, this access is invaluable.

5. Employee Motivation through Share Schemes:

A public listing enables EV companies to offer share-based compensation schemes more effectively. These schemes can attract and retain talent by aligning employee interests with the company’s success.

The Potholes of Stock Exchange Listing

- High Costs for Small Entities: The costs associated with preparing for and maintaining a stock exchange listing can be prohibitive for smaller EV companies. These costs include fees for legal, accounting, and advisory services, as well as ongoing listing fees.

- Rigorous Reporting Requirements: Public companies are subject to stringent reporting and disclosure requirements. For EV companies, which often operate in rapidly evolving markets, these requirements can be particularly onerous, requiring significant resources and potentially diverting focus from core activities.

- Stringent Listing Rules: The rules for obtaining a quotation on a stock exchange can be stringent, requiring companies to meet specific financial, governance, and operational criteria. For innovative EV companies, some of these criteria can be challenging to meet, especially in their early stages.

Conclusion

For electric vehicle companies, the decision to list on a stock exchange is not one to be taken lightly. It requires a careful assessment of the advantages and disadvantages, a clear understanding of the company’s long-term strategy, and a readiness to meet the demands of public markets. While the benefits of access to capital, increased visibility, and enhanced credibility are significant, the costs, regulatory burdens, and operational impacts also demand thorough consideration.

As the EV market continues to grow, driven by global efforts to combat climate change and transition to sustainable transportation, the role of public markets in supporting this sector will undoubtedly evolve. EV companies considering a stock exchange listing must navigate this landscape with foresight, adaptability, and a commitment to leveraging public markets to fuel their growth and contribute to a greener future.