In the dynamic world of Electric Vehicles (EVs), understanding the financial health and performance of companies is crucial for investors. The International Accounting Standard (IAS) 33 offers a robust metric for this analysis: Earnings Per Share (EPS). Let’s delve into the significance of EPS in the EV industry, particularly in the Indian market.

What is Earnings Per Share?

EPS is a financial ratio that allocates a company’s profits to each outstanding share of common stock, serving as an indicator of a company’s profitability. Simply put, it tells us how much money a company makes for each share of its stock and is a powerful tool in the hands of investors to compare profitability across companies, even those within India’s burgeoning EV sector.

Calculating Basic EPS:

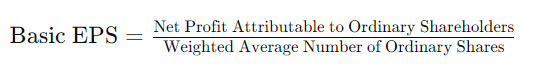

The formula for Basic EPS is:

To calculate earnings, we consider the net profit after taxes and subtract any preference dividends. The resulting figure is divided by the weighted average number of ordinary shares over the reporting period.

Earnings / Net Profit Computation Table:

| Component | Calculation | Remarks |

|---|---|---|

| Net Profit after Tax | XX | Consolidated entity’s profit |

| Less: Non-controlling Interest | (X) | Excludes interest not controlled by the parent |

| Less: Preference Dividend | (X) | Dividends for preference shareholders |

| Earnings | XX | Utilized in EPS calculation |

Weighted Average Shares:

To reflect the changing number of shares across a financial period, we use the weighted average of shares. It’s the sum of shares outstanding, adjusted for the time they were available during the period. For example, if additional shares are issued or repurchased partway through the year, this formula adjusts the share count accordingly.

Certainly, the concept of weighted average shares adjusts for changes in the number of shares over a period. This ensures that EPS calculations are fair and proportionate to the time each share spent in circulation. Here’s how it’s typically tabulated:

| Date | Event | Shares Before Event | Adjustment Factor | Weighted Average Shares |

|---|---|---|---|---|

| Jan 1 | Starting Shares | 1,000,000 | Full year (1.0) | 1,000,000 |

| Jun 1 | Issue New Shares | +500,000 | Half year (0.5) | +250,000 |

| Dec 1 | Repurchase Shares | -100,000 | One month (~0.08) | -8,333 |

| Total | Weighted Average: 1,241,667 |

If a company starts with 1,000,000 shares, issues an additional 500,000 shares halfway through the year, and then repurchases 100,000 shares in the last month, the weighted average will be adjusted to 1,241,667 to reflect these changes for the EPS calculation.

Indian EV Industry Example:

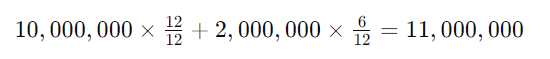

Let’s consider Reva Electric Car Company, based in India. Suppose Reva reported a net profit of INR 150 million for the year and declared no preference dividends. At the beginning of the year, Reva had 10 million shares outstanding, but issued 2 million more on July 1st.

The weighted average number of shares for Reva would be:

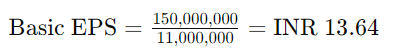

Hence, the Basic EPS for Reva would be:

Bonus Shares and EPS:

When bonus shares are issued, the total equity of the company does not change because the bonus shares are typically issued from the company’s reserves, like the share premium account. Since issuing bonus shares does not involve any cash flow, the company’s assets and liabilities remain unchanged. However, the number of shares outstanding increases, which can dilute the earnings per share (EPS) if not adjusted properly.

Here’s a step-by-step explanation of how to calculate basic EPS when bonus shares are issued, including restating previous periods’ EPS:

Step 1: Calculate Total Shares After Bonus Issue

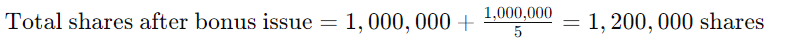

For every 5 shares held, 1 bonus share is given. If a company had 1,000,000 shares before the bonus issue, after the bonus issue, there would be:

Step 2: Restate Previous Period’s EPS

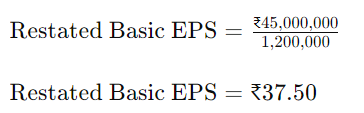

The EPS for previous periods needs to be recalculated as if the bonus shares had been issued at the beginning of those periods. This provides a comparable EPS figure across years. If last year’s EPS was calculated with 1,000,000 shares and this year the number has increased to 1,200,000 due to bonus shares, last year’s EPS should be recalculated using the new total number of shares.

Step 3: Calculate Current Period’s Basic EPS

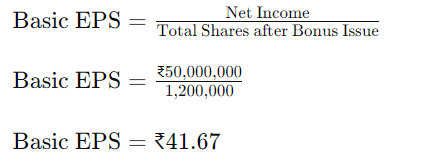

Basic EPS is calculated by dividing the net income attributable to ordinary shareholders by the weighted average number of shares during the period. After the bonus issue, the weighted average number of shares is the total number of shares including the new bonus shares, as no time-weighting is necessary because it’s assumed that the bonus shares were outstanding for the entire period.

Example:

Let’s consider an example with Reva, an EV company in India:

- Before the bonus issue: 1,000,000 shares

- Net income for the current year: ₹50,000,000

- Bonus issue: 1 for every 5 shares held

- After the bonus issue: 1,200,000 shares (1,000,000 + 200,000 bonus shares)

Let’s calculate the EPS for the year: Step 1

So, after issuing bonus shares, the Basic EPS for Reva would be ₹41.67 per share.

Step 2: let’s calculate the restated EPS for the previous year if the net income was ₹45,000,000:

The restated Basic EPS for the previous year would be ₹37.50 per share. This restated figure allows investors to compare the company’s year-on-year performance on a like-for-like basis, taking into account the increase in the number of shares due to the bonus issue.

Here’s how the table would be structured with the example data:

| Year | Net Income (₹) | Shares before Bonus Issue | Bonus Shares Issued | Total Shares after Bonus Issue | Basic EPS (₹) |

|---|---|---|---|---|---|

| Previous Year (Basic EPS) | 45,000,000 | 1,000,000 | – | 1,000,000 | 45.00 |

| Previous Year (Restated EPS) | 45,000,000 | 1,000,000 | 200,000 | 1,200,000 | 37.50 |

| Current Year | 50,000,000 | 1,000,000 | 200,000 | 1,200,000 | 41.67 |

Conclusion:

Understanding EPS and its computation, including the impact of events like bonus shares, is fundamental in evaluating EV companies like Reva. It empowers investors and stakeholders to make informed decisions in a market that’s accelerating as rapidly as the vehicles themselves.

Takeaway:

Grasping the essence of EPS can illuminate the fiscal roadmap of EV entities in India, projecting their journey from production lines to profit margins, and from market presence to market dominance.