In the electric vehicle (EV) industry, a surge of innovative financing mirrors the technological revolution on the roads. A concept central to understanding a company’s financial health is Earnings Per Share (EPS), and more specifically, its variant — the Dilated Earnings Per Share (DEPS).

Diluted EPS (DEPS), a critical figure for shareholders who wish to understand the potential impact of convertible securities on the company’s earnings. In the burgeoning Electric Vehicle (EV) sector, where innovation meets investment, understanding diluted EPS is paramount.

What is Diluted EPS?

Diluted EPS is a financial metric that captures the quality of earnings per share if all convertible instruments were exercised. These instruments are known as “potential ordinary shares” and could be anything that can be converted into equity shares.

Imagine you have a bottle of concentrated orange juice. To make it drinkable, you add water, spreading the flavor across a larger volume. Initially, the flavor (or “earnings” in financial terms) is strong because it’s concentrated in a smaller volume. When water is added (analogous to potential ordinary shares), the flavor per unit of volume decreases because it’s spread out more thinly.

Dilution means that each existing share’s ownership percentage decreases as new shares are issued. This is especially significant in the EV sector, where companies often reward employees with share options or seek funding through convertible instruments.

Examples of “Potential Ordinary Shares Include”

- Convertible Debt: Such as bonds or debentures which can be converted into equity shares.

- Convertible Preference Shares: That holders can exchange for a predefined number of ordinary shares.

- Options and Warrants: Rights to purchase shares at a specific price within a certain timeframe.

Why It Matters?

The relevance of diluted EPS, especially in the context of the electric vehicle (EV) industry, hinges on a few key aspects:

- Investor Insight: Just as someone might want to know how much soda they can add to their alcohol without losing its kick, investors use diluted EPS to gauge how future conversions of securities could affect their share of earnings.

- Comparative Analysis: It allows investors to compare the performance of companies on a like-for-like basis, considering all potential dilutive effects on earnings, much like comparing two diluted drinks on their taste strength.

- Strategic Decisions: For companies in the EV industry, understanding diluted EPS helps in making strategic decisions about issuing convertible securities or employee stock options as part of compensation packages.

- Compensation Plans: For companies, especially in the tech and startup sectors, which often use share-based payments as a part of compensation, this calculation is crucial for understanding the future impact on ownership percentages and EPS.

- Regulatory Compliance: For financial reporting under standards like IFRS and GAAP, it’s a required part of disclosing the EPS in financial statements, offering a more comprehensive view of a company’s earnings performance.

In essence, diluted EPS offers a more comprehensive understanding of a company’s profitability by accounting for all possible dilutive securities. It’s like planning for a party where you know exactly how much soda you need to add to the alcohol to cater to everyone’s taste, ensuring there are no surprises in the strength of the drink

Calculating Diluted EPS:

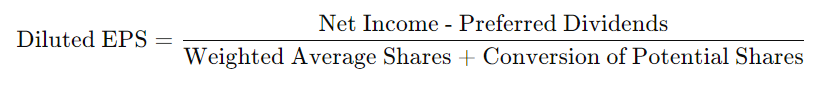

The formula for calculating Diluted EPS is straightforward yet powerful:

To understand this formula in the context of the EV industry, let’s consider an example with hypothetical figures for an Indian EV company, ‘ElectroMotive Inc.’

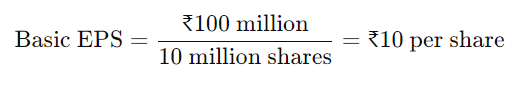

Basic EPS Example:

- Net Income for the Year: ₹100 million

- Preferred Dividends: ₹0 (Assuming no preference shares exist)

- Weighted Average Shares Outstanding: 10 million

Diluted EPS Example:

To calculate the Diluted Earnings Per Share (DEPS) for scenarios involving both convertible bonds and convertible preference shares, we need to make adjustments to account for the specific characteristics of these financial instruments, including the effects of tax implications for convertible bonds and the lack of tax relief for preference dividends. Let’s delve into each scenario separately.

Scenario 1: Convertible Bonds

Given the Basic information:

- Net Income for the Year: ₹100 million

- Basic EPS: ₹10 per share

- Weighted Average Shares Outstanding: 10 million shares

Let’s assume the company issued convertible bonds that pay an annual interest of ₹5 million, and these bonds are convertible into 1 million shares after 5 years. The tax rate is 30%.

Adjusting Earnings for DEPS Calculation:

- Calculate the after-tax interest on the convertible bonds: Interest on bonds is tax-deductible. Therefore, the after-tax interest saved (which would have been an expense had the bonds not been convertible) is added back to the net income. After-tax interest saved = Interest on bond × (1 – Tax rate) = ₹5 million × (1 – 0.30) = ₹3.5 million

- Adjusted Earnings for DEPS: Add the after-tax interest saved to the net income. Adjusted Earnings = Net Income + After-tax interest saved = ₹100 million + ₹3.5 million = ₹103.5 million

- Calculate DEPS: DEPS = Adjusted Earnings / (Weighted Average Shares + Shares from bond conversion) Assuming the bonds convert to 1 million additional shares: DEPS = ₹103.5 million / (10 million + 1 million) = ₹9.41 per share

Scenario 2: Convertible Preference Shares

Given the same initial conditions, let’s assume instead of bonds, there are convertible preference shares that are convertible into 1 million ordinary shares, and these preference shares pay dividends of ₹5 million annually. Since preference dividends do not attract tax relief, the calculation changes slightly.

- Adjusted Earnings for DEPS: For convertible preference shares, the preference dividends are not tax-deductible, so we only subtract the preference dividends from the net income without adjusting for taxes. Adjusted Earnings = Net Income – Preference dividends = ₹100 million – ₹5 million = ₹95 million

- Calculate DEPS: DEPS = Adjusted Earnings / (Weighted Average Shares + Shares from preference share conversion) DEPS = ₹95 million / (10 million + 1 million) = ₹8.64 per shares.

Scenario 3: When Share Options are Issued

Let’s continue with the example of ElectraMotors, keeping the same figures:

- Net Income: ₹100 million

- Basic Shares Outstanding: 10 million

- Options Granted: 1 million

- Exercise Price of Options: ₹90

- Average Market Price: ₹100

Using the formula for no consideration:

Number of options issued for no consideration = (Fair value of share price – Exercise price of shares) / Fair value of share price.

The formula mentioned is used to calculate the number of shares that would be hypothetically purchased if the options were exercised and the proceeds were used to buy shares at the current market value. Fair Value Perspective, This calculation assumes that the company “buys back” the shares using the cash received from the option exercise, which reflects the transaction from a fair value perspective.

So, it would be = (₹100 – ₹90) / ₹100 = ₹10 / ₹100 = 0.1 or 10%

Let’s calculate how this impacts,

- Total Number of shares under options = 10+0.1 = 10.1 million

- Earnings = ₹100 million

- Calculate the Diluted EPS: Net Income / Adjusted Weighted Average Shares = ₹100 million / 10.1 million = ₹9.90 per share

Tabulated Summary:

| EPS Type | EPS (₹) | Notes |

|---|---|---|

| Basic EPS | 10.00 | |

| DEPS for Convertible Bonds | 9.41 | Assumes conversion of bonds |

| DEPS for Convertible Preference Shares | 8.64 | Assumes conversion of shares |

| DEPS for Share Options Issued | 9.90 | Assumes exercise of options |

In dynamic industries like the Indian EV market, equity-based compensation in the form of share options is a key strategy for businesses to align employees’ interests with shareholders. However, these instruments can dilute the EPS when exercised, which impacts shareholders’ value. The DEPS calculation including share options, as shown above, provides a more realistic picture of a company’s earnings potential on a per-share basis when all potential dilutive securities are converted into ordinary shares.

Conclusion:

In each case, the DEPS provides a “what-if” scenario, helping investors understand the impact of all potential conversions on their earnings per share. It’s a crucial tool in the decision-making arsenal for investors looking at the long-term prospects of any EV company venturing into the future on the wheels of innovation and sustainable technology.

This explanation simplifies the complex calculations into an understandable narrative, integrating the concept of DEPS within the context of the EV industry, particularly focusing on the Indian market. Remember, the actual calculations would require more precise data and follow the specific guidance of the IAS 33 standard.