In the electric vehicle (EV) sector, engineering breakthroughs drive progress. However, understanding the financial health of a venture is equally crucial. For engineers transitioning into the realm of business or entrepreneurship within the EV industry, grasping the concept of revenue and its role in the Profit & Loss (P&L) account is foundational. Let’s demystify this financial metric, often seen as the lifeblood of a company, and explore how it reflects in the P&L statement.

What is Revenue?

Imagine revenue as the total energy output of a battery pack in an electric vehicle – it’s the starting point that powers the journey. In business terms, revenue represents the total income generated from the sale of goods or services related to a company’s primary operations. This could range from the sale of EVs, charging services, to after-sales maintenance.

Key Components of Revenue:

- Sales of Goods: Like an EV manufacturer selling its latest model.

- Rendering of Services: Offering charging station access or vehicle servicing.

- Interest: Income from investing surplus funds.

- Royalties: Payments for using your patented technology.

- Dividends and Lease Income: Earnings from investments and renting out assets.

P&L Account: The Circuitry of Finance

The Profit & Loss account, akin to an electrical circuit, begins with the total energy input (gross revenue) and deducts the energy spent (expenses) to measure the output (net income).

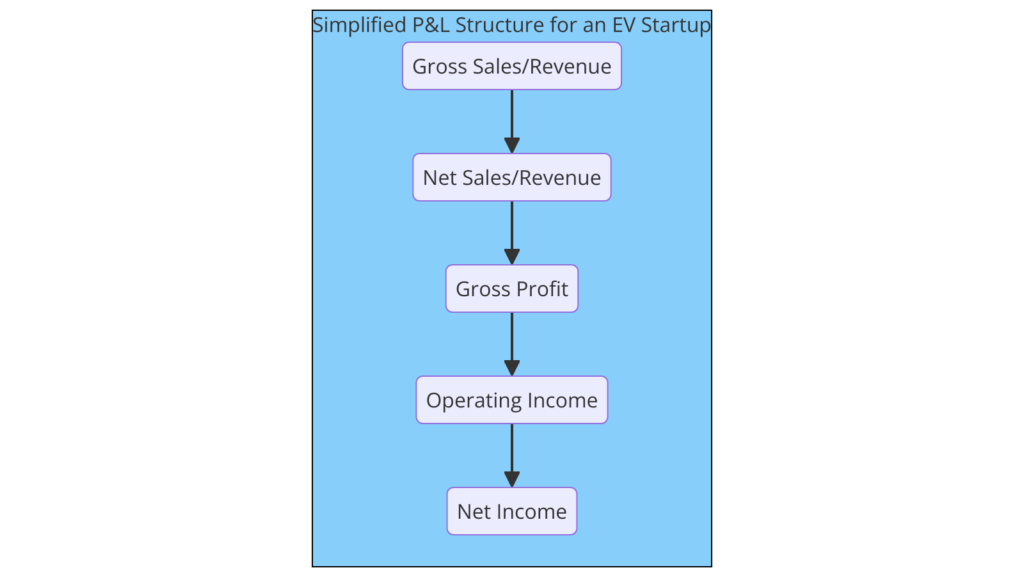

Simplified P&L Structure for an EV Startup:

- Gross Sales/Revenue: Income from EV sales and charging station services.

- Net Sales/Revenue: Gross revenue minus returns, allowances, and discounts.

- Gross Profit: Net revenue minus the cost of goods sold (COGS), like manufacturing costs.

- Operating Income: Gross profit minus operating expenses (marketing, R&D).

- Net Income: The ‘charge’ left after all expenses, including taxes and interest, are deducted.

Understanding Through an Example:

Let’s consider ElectraDrive, an EV startup:

- Gross Sales: ₹150 million from selling 1,000 EVs.

- Returns and Discounts: ₹5 million.

- Net Sales: ₹145 million.

- COGS: ₹90 million (production costs).

- Gross Profit: ₹55 million.

- Operating Expenses: ₹20 million (R&D, marketing).

- Operating Income: ₹35 million.

- Interest Income: ₹2 million.

- Net Income (before tax): ₹37 million.

- Taxes: ₹7 million.

- Net Income: ₹30 million.

| Description | Amount (₹ million) | Details | Accounting Entries |

|---|---|---|---|

| Gross Sales | 150 | Income from selling 1,000 EVs | Debit Cash/Bank ₹150 million, Credit Sales Revenue ₹150 million |

| Returns and Discounts | -5 | Returns and discounts on sales | Adjustments in sales revenue |

| Net Sales | 145 | Gross Sales after adjustments | – |

| COGS | -90 | Production costs | Debit COGS ₹90 million, Credit Inventory ₹90 million |

| Gross Profit | 55 | Net Sales – COGS | – |

| Operating Expenses | -20 | R&D, marketing expenses | Debit Operating Expenses ₹20 million, Credit Cash/Bank ₹20 million |

| Operating Income | 35 | Gross Profit – Operating Expenses | – |

| Interest Income | 2 | Income from investments | – |

| Net Income (before tax) | 37 | Operating Income + Interest Income | – |

| Taxes | -7 | Tax expenses | Debit Tax Expense ₹7 million, Credit Cash/Bank ₹7 million |

| Net Income | 30 | Net Income after taxes | – |

Revenue Recognition Model

Revenue recognition practices have historically been an area ripe for manipulation, with companies sometimes overstating or understating their revenue to influence perceptions among investors, stakeholders, or to optimize tax liabilities. This manipulation not only distorts the company’s financial health but also misleads investors and other stakeholders making decisions based on the financial statements.

To address these concerns and to provide a robust framework for revenue recognition, the International Financial Reporting Standards (IFRS) introduced IFRS 15, “Revenue from Contracts with Customers.” Implemented from January 1, 2018, IFRS 15 establishes a comprehensive, principle-based approach for revenue recognition across all industries, including the rapidly evolving electric vehicle (EV) sector. Lets understand this topic in next Blogpost.

Conclusion:

For engineers stepping into the EV industry’s business side, understanding revenue and its flow through the P&L statement is akin to mastering the basics of an electric circuit. It empowers you to gauge the financial dynamics of your projects or company. Just as efficiently managing energy output is key to an EV’s performance, adeptly navigating financial statements is crucial for a business’s health and growth.

This blog post is designed to simplify the concept of revenue and the structure of the P&L account for engineers and technical professionals venturing into the EV industry, illustrating how integral financial literacy is in driving innovation and business success forward.