In the burgeoning electric cycle industry, understanding the nuances of financial management is as crucial as innovation in design and technology. Among these financial concepts, the Cost of Debt (Kd) stands out, especially when it comes to bank borrowings and irredeemable (or undated) bonds. This post delves into how the actual cost of debt is influenced by tax considerations, using the electric cycle industry as a case study to illuminate these principles.

The Essence of Cost of Debt

The Cost of Debt (Kd) is the effective rate that a company pays on its current debt. This figure is crucial because it helps businesses assess the affordability of their borrowing strategies. However, the actual cost of debt is often lower than the stated interest rate due to the tax-deductible nature of interest expenses.

1. Bank Borrowings

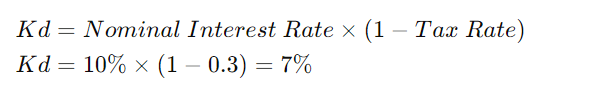

Bank loans are a common source of funding for electric cycle manufacturers, providing the capital necessary to invest in production facilities, R&D, and market expansion. The interest rate on these loans represents the nominal cost of debt. However, since interest payments on debt reduce taxable income, the effective cost of debt is lower when considering the tax shield.

Example: Let’s consider “EcoRide Cycles,” an electric cycle manufacturer that secures a bank loan at an interest rate of 10%. Assuming the corporate tax rate is 30%, the effective cost of debt can be calculated as follows:

Thus, the effective cost of debt, after accounting for the tax shield, is reduced to 7%.

Learn More: Internal Rate of Return in Finance: A Full Guide EV Industry Examples

2. Irredeemable Bonds / Undated Bonds

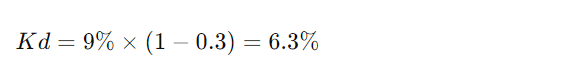

Irredeemable bonds, another financing option, do not have a maturity date. These bonds offer a fixed interest rate over an indefinite period, making them a perpetual source of capital. Like bank borrowings, the interest paid on these bonds is tax-deductible, affecting the cost of debt similarly.

Example: “EcoRide Cycles” issues irredeemable bonds with a 9% annual interest rate. With the same corporate tax rate of 30%, the effective cost of debt is:

The tax shield lowers the cost to 6.3%, making it a more attractive option for raising capital compared to the nominal rate.

The Impact of Tax on Cost of Debt

The examples of “EcoRide Cycles” demonstrate the significance of the tax shield in reducing the cost of debt for companies in the electric cycle industry. By lowering taxable income through interest expenses, businesses can effectively decrease their overall financing costs. This reduction enables more strategic investment back into the company, fueling innovation, expansion, and the pursuit of sustainability goals within the electric cycle sector.

Conclusion

Understanding the cost of debt is paramount for electric cycle manufacturers navigating the competitive landscape. The ability to leverage tax advantages to reduce the effective interest rate on debt can provide these companies with a crucial edge. As “EcoRide Cycles” shows, smart financial strategies are not just about managing costs but also about maximizing opportunities for growth and innovation in the electric mobility revolution