In the realm of accounting, the concepts of contingent assets and liabilities represent potential financial impacts tied to uncertain events. Their existence hinges on outcomes that businesses often cannot control. In this post, we’ll decipher these conditional elements and explain their treatment in financial records, particularly pertinent to complex scenarios such as legal disputes or insurance claims.

Contingent Liability: A Potential Financial Obligation

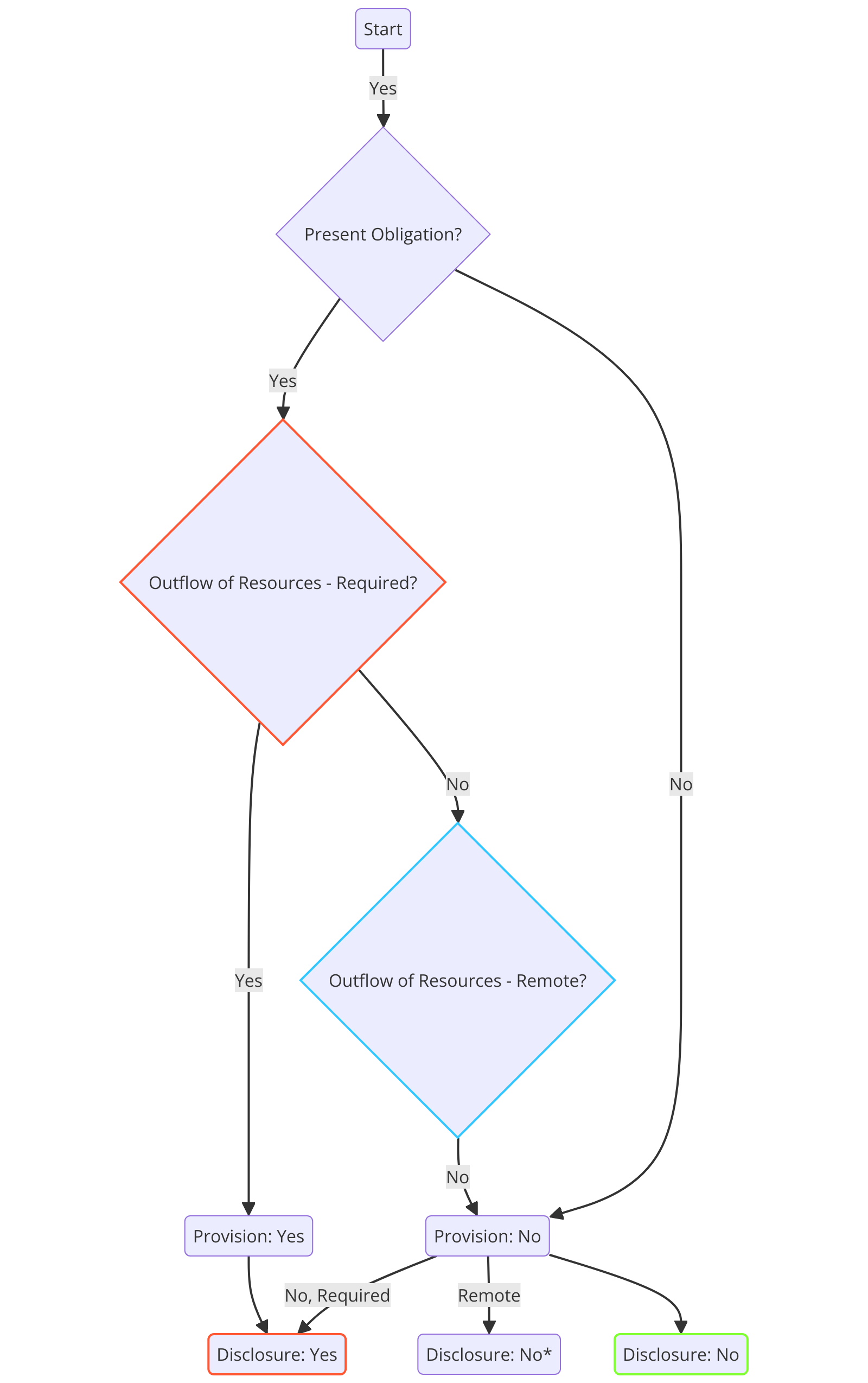

A contingent liability is a potential responsibility that may emerge due to past transactions or events, but its validation depends on future happenings. The recognition in financial statements is contingent on the likelihood of the outflow of resources. If this likelihood is less than 50%, it becomes a note in the financial disclosures rather than a line item in the books.

Contingent liabilities Conditions:

1. Possible Obligation Arising from Past Events:

- This refers to a situation where a past event may create a liability.

- Example: A company faces a lawsuit from a competitor for alleged patent infringement. The lawsuit arose from product development events in the past.

2. Present Obligation Not Recognized Due to Uncertainty:

- A current obligation exists but is not recognized because:

- It is not probable that resources will be required to settle it (probability of outflow is less than 50%).

- Example: The company believes it’s unlikely to lose the lawsuit, or it can’t estimate the potential damages due to the complexity of the case.

3. Obligation Confirmed by Future Events Not in Entity’s Control:

- The final confirmation of the liability depends on future events that the company cannot control.

- Example: The lawsuit’s outcome is pending in court. Only the court’s decision will confirm whether the company is liable or not.

Accounting of contingent liabilities:

At initial recognition (when a liability is possible but not probable):

- No entry in the financial statements.

- Disclosure in the notes about:

- Nature of the contingency.

- Financial impact estimate.

- Associated uncertainties.

Upon resolution (when a liability becomes probable and estimable):

When a company faces such a situation, it needs to disclose the contingent liability in the financial statement notes if it is not recognized on the balance sheet. The disclosure would include the nature of the contingent liability, an estimate of its financial effects, and the uncertainties surrounding it.

- Dr. Expense or Loss (reflecting the nature of the contingency)

- Cr. Contingent Liability

Example:

Imagine a company, EV Tech Inc., is currently facing a legal battle over a patent dispute. The outcome is uncertain, and lawyers are unable to estimate potential costs reliably. In this case, EV Tech Inc. would disclose the situation in the financial statement notes but would not recognize a provision until the case’s outcome becomes more predictable and the costs more estimable.

Contingent Asset:

A Potential Financial Gain

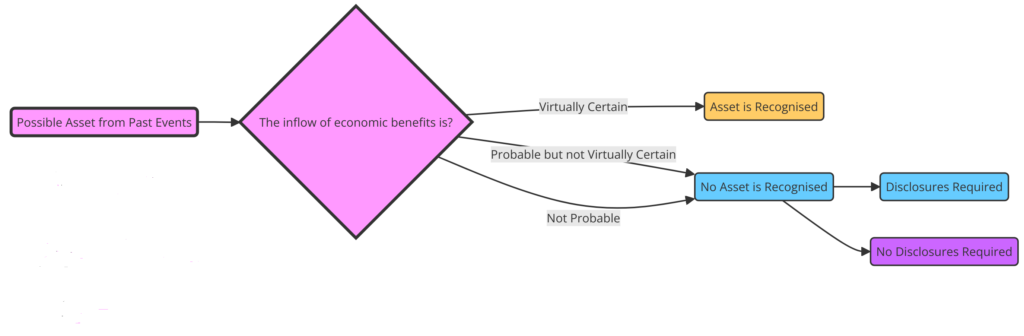

A contingent asset is the flip side—a possible asset arising from past events, waiting on future events to confirm its existence.

Accounting Entries for Contingent Assets:

- At initial recognition (when an asset is possible but not probable):

- No entry in the financial statements.

- Disclosure in the notes if the inflow is probable.

- Upon confirmation (when an asset becomes virtually certain):

- Dr. Receivable or Asset

- Cr. Gain or Income

Example:

ElectraCharge, an EV charging network, awaits an insurance payout after a station fire, expecting a 27 million INR claim. The insurance decision is pending, and hence, ElectraCharge notes the potential receivable but doesn’t recognize it in its financials until the claim is confirmed.

Conclusion

In business, especially within industries like the burgeoning EV market, the concepts of contingent assets and liabilities are crucial in financial planning and transparency. Their recognition and disclosure ensure that stakeholders have a clear picture of a company’s fiscal health, while the company itself maintains a prudent approach to its potential financial obligations and receivables.

Note: This post is intended to provide a general understanding and should not be taken as financial advice. Consult with a professional for financial decisions.