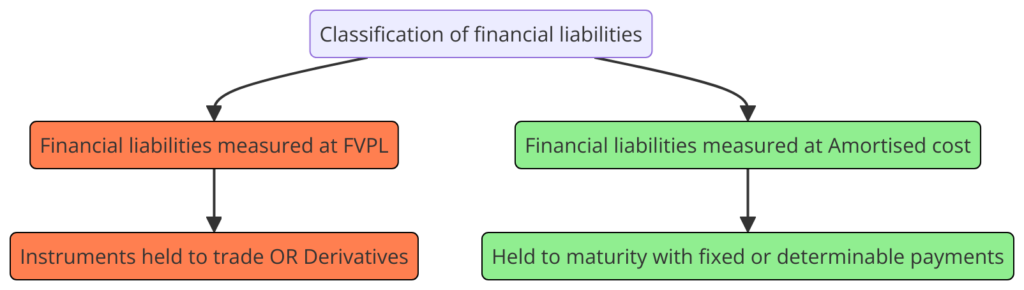

In accounting and finance, classification is crucial because it defines the rules and conditions under which a transaction is measured. Without classification, there is no consistent basis for measurement. This principle is particularly pertinent when dealing with financial liabilities, which maps out the categorization and subsequent measurement of such liabilities.

Classification

Consider the field of electric vehicles (EVs), where each component’s financial impact can vary significantly depending on its classification. For example, an EV company may finance the production of a new electric car model through various means, such as issuing bonds, taking out a bank loan, or entering into derivative contracts for price hedging.

Example: “ElectroCar Inc.” needs to finance its new electric car model. They have the following options:

- Issue bonds to raise capital.

- Take out a bank loan.

- Enter into a derivative contract to manage the risk of raw material price fluctuation.

Before these financial instruments can be measured in the books, they need to be classified according to their characteristics:

- Bonds: If intended to be held to maturity, they could be classified under ‘Financial liabilities measured at amortized cost.’

- Bank Loan: Typically falls under ‘Financial liabilities measured at amortized cost,’ as it’s a debt with fixed or determinable payments.

- Derivatives: If used for hedging, they might be classified as ‘Financial liabilities measured at FVPL (Fair Value through Profit or Loss).’

Initial Measurement: The Lap of Valuation

The initial measurement of financial liabilities under two different categories according to financial reporting standards: Fair Value through Profit or Loss (FVPL) and Amortised Cost.

Financial Liabilities Measured at FVPL

ElectroMotors Inc. decides to raise funds by issuing a bond with a face value of INR 1,000,000. The market is willing to pay INR 1,000,000 for the bond, which is its fair value. The company incurs INR 50,000 in transaction costs related to legal fees, underwriting, and other issuance costs.

- At Initial Recognition:

- The cash received from the bond issuance is INR 950,000 (Fair Value of INR 1,000,000 minus Transaction Costs of INR 50,000).

- The transaction cost of INR 50,000 is recognized as an expense immediately in the profit or loss statement.

- Debit Cash: INR 950,000

- Debit Transaction Costs (Expense): INR 50,000

- Credit Bond Liability: INR 1,000,000

The impact of this entry is that ElectroMotors Inc. records the full value of the bond as a liability while recognizing the costs immediately as an expense, reflecting the lower amount of cash actually received.

Financial Liabilities Measured at Amortised Cost

Alternatively, if ElectroMotors Inc. issues the same bond but opts to classify it at amortised cost, the initial accounting treatment differs:

- At Initial Recognition:

- The bond is initially recognized at the amount of cash received (INR 950,000), net of transaction costs.

- The transaction costs are not expensed immediately but are instead included in the initial measurement of the bond liability and amortized over the life of the bond.

- Debit Cash: INR 950,000

- Credit Bond Liability: INR 950,000

In this case, the liability on ElectroMotors Inc.’s balance sheet represents the net amount received, and the costs will be recognized as part of interest expense over the period through the effective interest method

In both cases, the EV company receives less cash than the nominal value of the loan note due to the transaction costs. The main difference lies in how these transaction costs are treated. Under FVPL, the costs are immediately expensed, whereas, under Amortised Cost, they are included in the initial measurement of the liability and expensed over time.

Conclusion

Classification is like setting the rules before a race. It ensures that every participant (financial transaction) is competing in the correct category (measured appropriately). Without classification, measurement would be inconsistent and could lead to financial reports that don’t accurately represent the company’s financial status, leading stakeholders on a bumpy ride.

In the fast-paced EV industry, getting this right is not just about regulatory compliance but also about strategic financial management, influencing everything from investment decisions to risk management and profitability analysis.