India is rapidly shifting gears towards a greener future, and electric vehicles (EVs) are at the forefront of this transformation. Fueled by ambitious government initiatives to curb emissions and promote sustainable transportation,The Capital Market in India is attracting significant attention from investors and stakeholders. This blog post dives into the dynamics and opportunities shaping the capital market for EVs in India.

The Capital Market in India Poised for Takeoff

The Indian EV industry is on a promising trajectory. According to a study by CEEW Centre for Energy Finance, the market is projected to become a mammoth $206 billion opportunity by 2030, contingent on consistent progress towards national EV targets. This growth necessitates a staggering $180 billion in cumulative investments across vehicle production and charging infrastructure.

The positive sentiment is further bolstered by the influx of investments – a whopping $6 billion in 2021 alone – with private equity and venture capitalists finding the Indian EV landscape increasingly attractive.

Growth Drivers

Several factors are propelling the Indian EV market forward. Government policies like FAME (Faster Adoption and Manufacturing of Electric Vehicles) offer subsidies and incentives for EV manufacturers and consumers. This, coupled with rising environmental concerns and increasing fuel prices, is driving a shift in consumer preference towards cleaner mobility solutions. Additionally, advancements in battery technology, falling battery costs, and growing awareness about the benefits of EVs are further accelerating market acceptance.

Financing the E-revolution

The capital market is responding positively to the burgeoning EV industry. Investors are recognizing the immense potential of this sector, leading to a rise in dedicated EV-focused funds and increased investments in EV startups and established players.

Read About : Role of 7 Financial Advisors: How to raise capital for EV Business

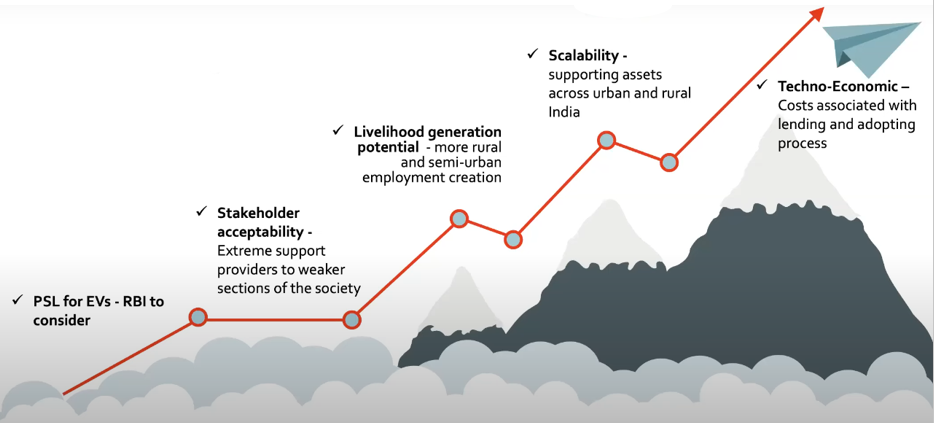

NITI Aayog estimates the EV financing market in India to reach a colossal $50 billion by 2030. This presents a lucrative opportunity for banks, non-banking financial institutions (NBFIs), and alternative financing models like peer-to-peer lending specifically designed for EV purchases.

Opportunities for Investors

The Indian EV market offers a plethora of investment opportunities across the entire value chain. Here are some key areas:

- EV Manufacturing: Investments in companies manufacturing electric two-wheelers, three-wheelers, passenger vehicles, and commercial vehicles.

- Battery Technology and Swapping Stations: Funding for research and development of advanced battery technology and creation of a robust network of battery swapping stations.

- Charging Infrastructure: Investments in setting up charging stations, including grid-connected and off-grid solutions, across India.

- Financial Services: Opportunities for banks and NBFIs to develop innovative financing solutions for EV purchases.

The Road Ahead

Despite the promising outlook, the Indian EV market faces certain challenges. Range anxiety due to limited charging infrastructure, higher upfront costs of EVs compared to traditional vehicles, and the nascent stage of battery recycling necessitate continued government support and industry innovation.

In conclusion, the capital market for EVs in India is brimming with exciting possibilities. With a supportive policy framework, growing consumer demand, and increasing investor interest, the Indian EV sector is poised for exponential growth. Overcoming the existing challenges will be crucial to unlocking the full potential of this transformative market and paving the way for a cleaner and more sustainable transportation ecosystem in India.