As the electric vehicle (EV) industry accelerates, the role of research and development (R&D) becomes more pivotal than ever. Under the guiding principles of IAS 38, companies like VoltWheelz are navigating the complex terrain of accounting for intangible assets. This blog post sheds light on the crucial stages of R&D and its financial implications as per IAS 38, illustrated with an example from the EV industry.

Lets Learn Stepwise:

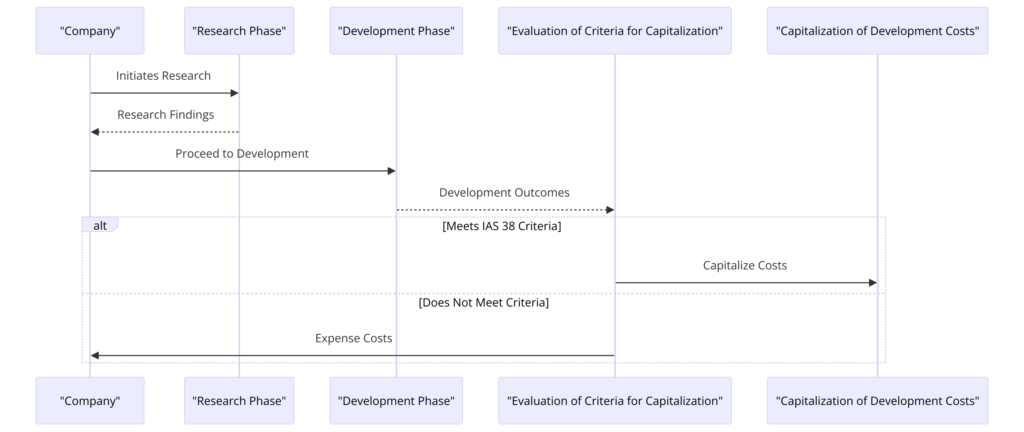

1. Initiating Research in the EV Landscape

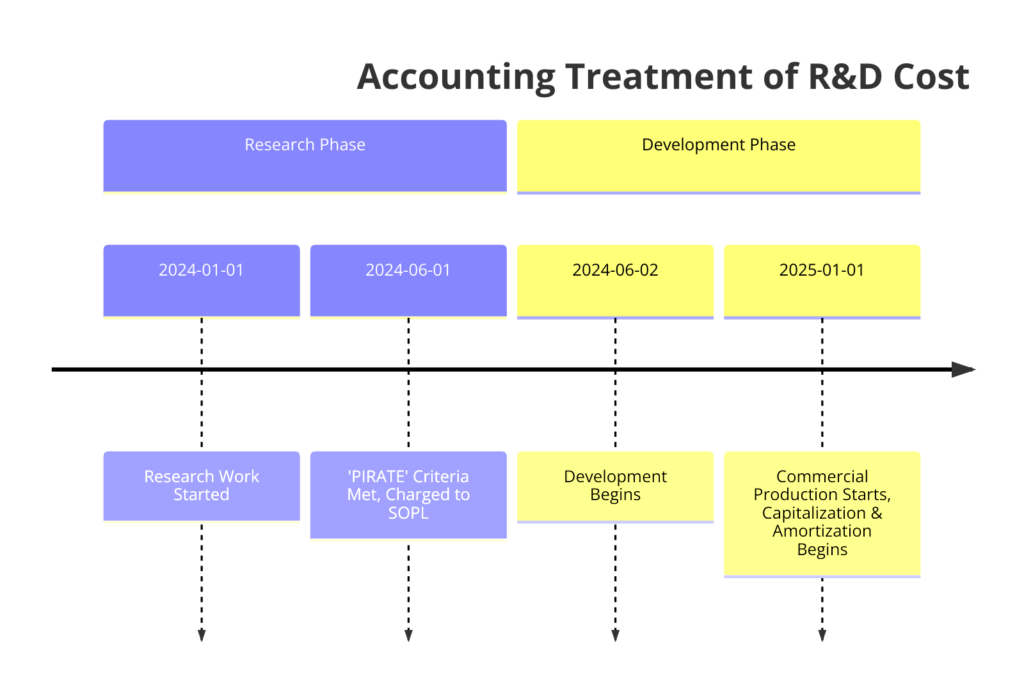

VoltWheelz embarks on a research journey to uncover groundbreaking battery technologies. This initial phase is exploratory, focusing on discovering new knowledge that could revolutionize electric mobility.

2. From Research Findings to Company Insights

After meticulous research, VoltWheelz identifies a potential breakthrough in battery efficiency. These findings are the seeds from which new and improved EV technologies can sprout.

3. Advancing to Development

With promising research in hand, VoltWheelz moves into the development phase. Here, the abstract becomes tangible as they devise plans to translate these insights into next-gen EVs with extended range and shorter charging times.

4. Outcomes and Evaluation

VoltWheelz evaluates the development outcomes against IAS 38’s criteria for capitalization. Are these innovations feasible, marketable, and likely to provide economic benefits? Only if the answer is affirmative do they proceed to the next step.

5. The Criteria for Capitalization Under Scrutiny (PIRATE Criteria)

For VoltWheelz’s developments to be capitalized, they must:

- Profitable : Show how the asset will generate future economic benefits.

- Intend to complete the intangible asset and use or sell it.

- Have the Resources to complete the development.

- The entity has a Ability to use or sell it.

- Demonstrate the Technical feasibility of completing the intangible asset for use or sale.

- Be able to measure the

Expenditure during development reliably.

6. The Financial Crossroads: Capitalization or Expensing

- Capitalizing Development Costs: VoltWheelz’s new battery tech passes the IAS 38 checkpoints. The R&D costs are now recognized as an intangible asset, indicating the anticipated flow of future economic benefits to the company.

- Expensing Development Costs: If VoltWheelz’s R&D had faltered at any of the criteria, the costs would be recorded as an expense, impacting the company’s current earnings.

Through this lens, VoltWheelz exemplifies strategic asset management. By adhering to IAS 38, they not only comply with accounting standards but also assure investors and stakeholders of their commitment to innovation and sound financial practices in driving the EV revolution forward.

Lets do One Example:

Ecobikewala, an electric two-wheeler manufacturing company, also operates a network of battery charging stations. The company embarked on a project to develop a new charging technology aimed at enhancing charging efficiency for their vehicles.

Problem Statement:

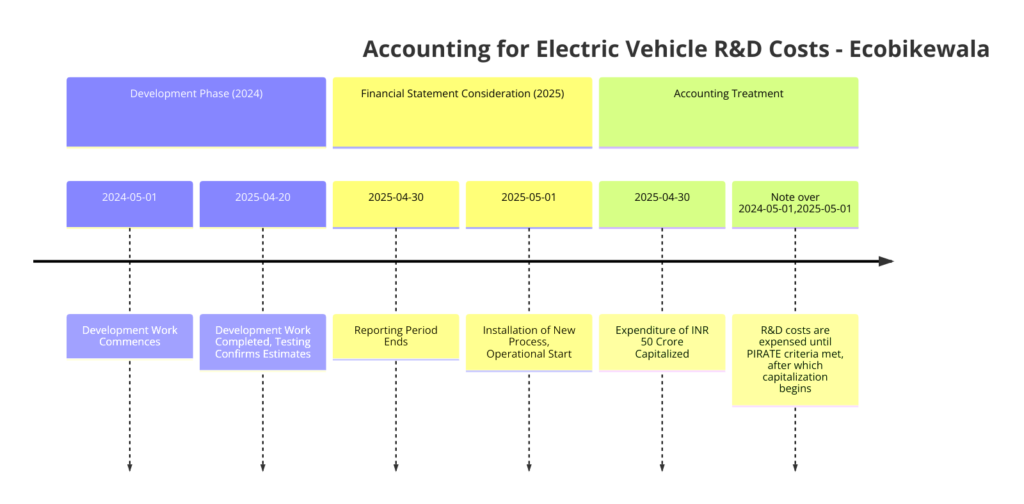

This development process spanned one year, starting on May 1, 2024, and concluding on April 20, 2025. At the onset of the development, Ecobikewala projected that this new technology could reduce charging times by 15% without incurring additional costs. Upon completion, testing verified that the new process indeed met Ecobikewala’s initial expectations.

Throughout the development period, Ecobikewala incurred a total expenditure of INR 50 Crores. The company has planned to implement this innovative charging process across all its stations, with operations set to commence on May 1, 2025. The financial reporting period for Ecobikewala concludes on April 30, 2025.

Required:

a) Discuss the criteria and requirements under IAS 38 for treating development costs as an intangible asset.

b) Describe how Ecobikewala should account for its development expenditures in the financial statements for the fiscal year ending on April 30, 2025.

Solution:

Ecobikewala’s development of a new charging technology that enhances charging efficiency by 15% is a significant innovation in the electric two-wheeler industry.

a) IAS 38 Intangible Asset Treatment for Development Costs:

IAS 38 stipulates that for development costs to be recognized as an intangible asset, certain criteria must be met: (PIRATE Criteria)

- Technical Feasibility: The entity must demonstrate that it can complete the intangible asset so that it will be available for use or sale.

- Intention to Complete and Use or Sell: The entity intends to complete the development and use or sell the asset.

- Ability to Use or Sell: The asset can generate probable future economic benefits. The company can demonstrate the existence of a market for the output of the intangible asset or the asset itself, or if it is to be used internally, the usefulness of the asset.

- Availability of Resources: The entity has adequate technical, financial, and other resources to complete the development and to use or sell the intangible asset.

- Measurement of Expenditure: The entity can reliably measure the expenditure attributable to the intangible asset during its development.

b) Treatment of Development Costs in Ecobikewala’s Financial Statements for the Year Ended 30 April 2025:

Given the scenario, Ecobikewala’s development project aligns with the criteria set forth in IAS 38:

Ecobikewala should recognize the INR 50 Crore as an intangible asset on its balance sheet as of 30 April 2025, as the development costs meet the capitalization criteria under IAS 38. This amount will be subject to amortization over its useful life, starting from 1 May 2025, when the new charging process is available for use.

Accounting Entries:

- At the end of the reporting period (30 April 2025), Ecobikewala would make the following journal entry to capitalize the development costs:

- Dr. Intangible Assets (Development Costs) INR 50 Crore

- Cr. Cash/Bank or Development Expense (to reflect the capitalization of development costs) INR 50 Crore

From 1 May 2025, when the asset is available for use, Ecobikewala would start amortizing the cost over its estimated useful life, reflecting the systematic consumption of the economic benefits embodied in the intangible asset.

Conclusion:

Navigating the nuances of R&D accounting in the EV industry, as per IAS 38, is much like engineering an EV itself. It requires precision, foresight, and a keen understanding of the rules of the road. VoltWheelz’s journey from the drawing board to the balance sheet exemplifies the meticulous approach needed to ensure that R&D propels not just technology, but also financial stability and investor confidence.

This blog post has journeyed through the essentials of R&D as delineated by IAS 38, with VoltWheelz serving as a case study. The EV industry continues to redefine transportation, and with IAS 38 as the compass, companies can ensure their financial reporting remains as innovative as the vehicles they aspire to create.