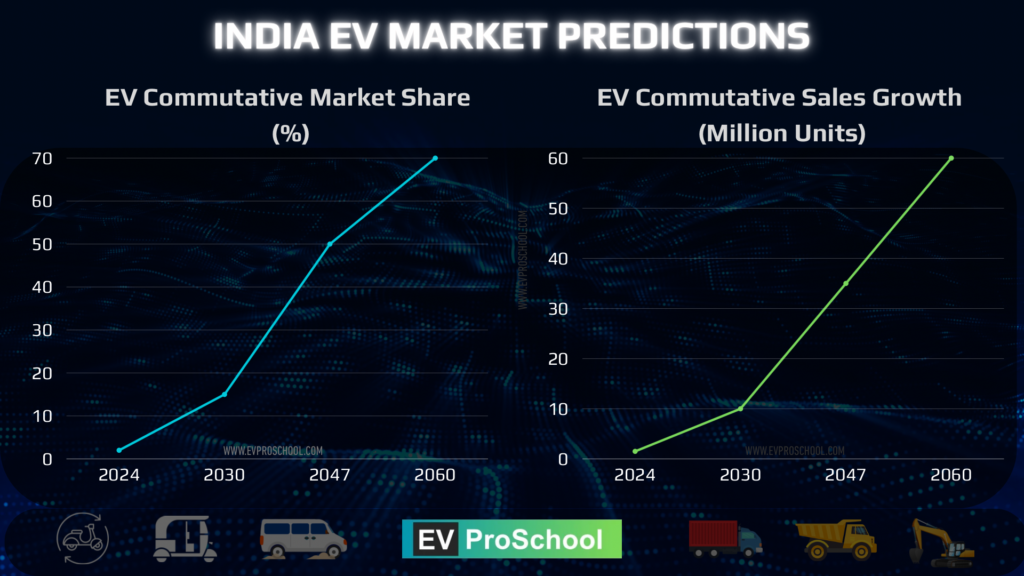

Imagine a street in your city where Noise & pollution-free, stylish electric vehicles are running, that day is not far away. By 2030, 50% of all passenger vehicles sold globally are expected to be electric, while EV adoption in India is projected to reach 20%. India is actively promoting zero-emission vehicles, with initiatives led by Transport Minister Nitin Gadkari, focusing on hydrogen and battery electric vehicles. Although China is ahead, India is steadily catching up in the EV race.

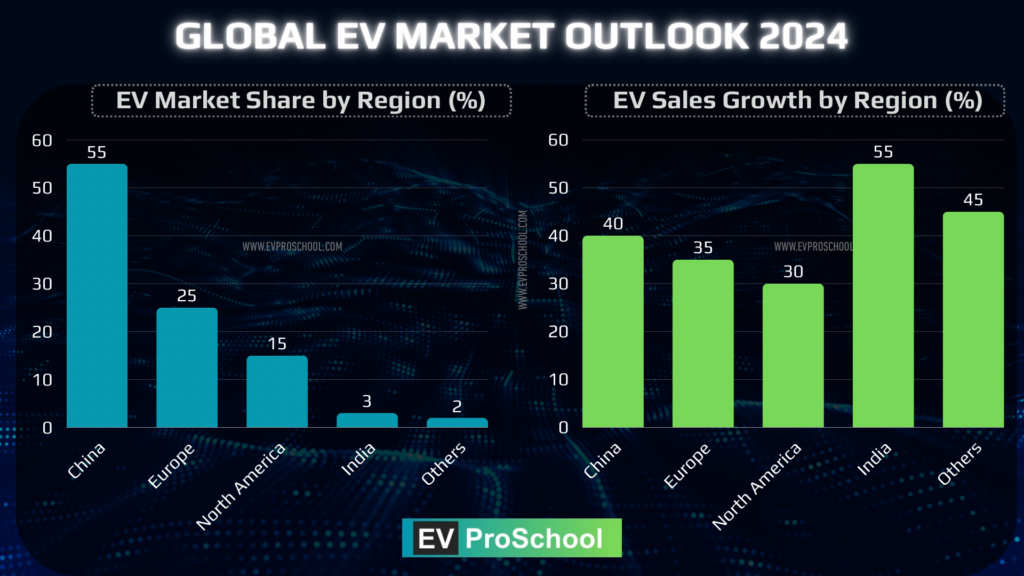

By the end of 2024, global EV sales are projected to reach 1.7 crore units, accounting for nearly 25% of new vehicle sales. The shift to EVs is not just about sustainability but also about meeting energy demands and emission targets. This blog explores the global EV market outlook, policies shaping adoption, China’s advancements, and India’s growing interest and government incentives.

EVs Disrupting the Global Auto Industry

The Global automotive industry is shaking up with the evolution in the EV Industry. Electric vehicles are challenging the traditional internal combustion engine vehicle. The established Automotive OEMs are being forced to rethink and change their narrative. This shift is not only technological but structural as well. It is changing market dynamics, supply chains, charging infrastructure Battery Technology, and New startup Businesses.

Tesla & BYD Scripting New History

In 2010 Electric vehicles were a niche market with the sales 0.01% of global car sales. Fast forward to 2024, the Global EV landscape has transformed radically today 14 million electric vehicles are sold annually which accounts for nearly 18% of all vehicles sold worldwide. Over the past 14 years companies like BYD, and Tesla have emerged and are dominating the EV market. They have set a new benchmark for innovation, market share, and Profitability, hence forcing traditional automakers like Volkswagen and others to adapt to the changing market.

From 2014 to 2024, tesla’s market cap has increased by 4500% to dollar 1.267 trillion. Similarly, BYD was founded in 1995 as a small battery manufacturer in 2023 providing revenue of approximately 682 Billion Chinese Yen (BYD). In 2023 the company achieved a milestone of selling over 3 million annual sales.

EVs going to be more affordable

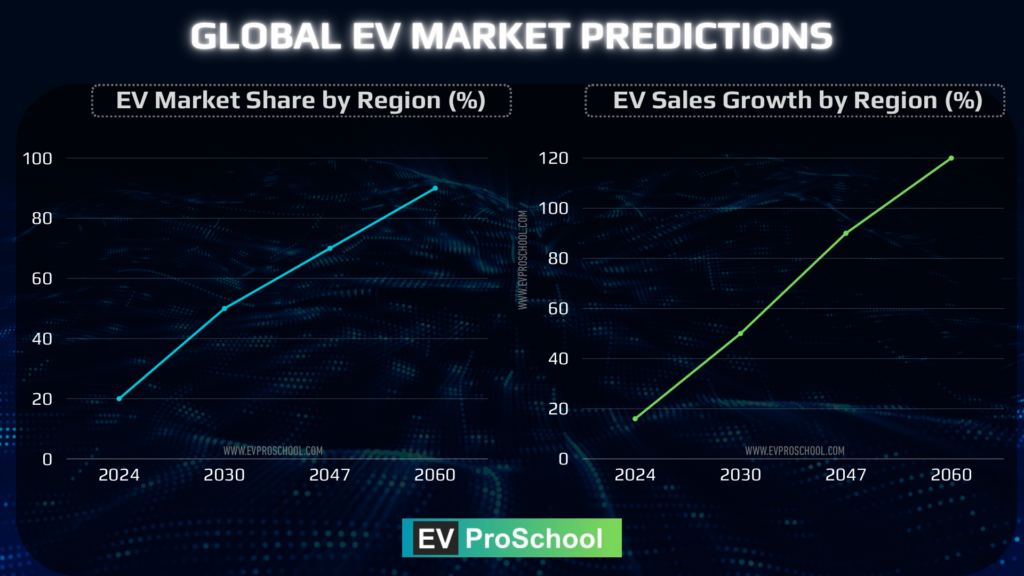

The global EV market is expected to grow far more rapidly over the next few years. It is projected that by 2030, 1 out of every 3 cars sold globally will be electric. EVs will penetrate 30 to 35% of the Global sales.

Key projections for 2030

- Globally EVs to surpass 40 million units annually from 14 millions today in 2023

- EV market share will grow I more than 50%

- Battery prices will decrease significantly reaching below $80 per kilowatt hour

- Many Countries, regions, and automobile OEMs will ban the production of new ICE vehicles by 2035.

China EV Industry

China currently dominates the global EV market, accounting for nearly 60% of global EV sales in 2024. The country’s strong government support, extensive charging infrastructure, and local manufacturers like BYD, NIO, and XPeng have made it the hub of electric mobility. Chinese EV brands are also expanding globally, further solidifying their leadership.

Key Drivers

Leading Chinese EV manufacturers include BYD, NIO, XPeng, and Li Auto. These companies have established extensive production facilities across China, particularly in regions such as Shenzhen, Shanghai, Guangzhou, and Hefei. Their manufacturing infrastructure is primarily domestic, with a focus on meeting both local and international demand.

In 2024, China’s new energy vehicle (NEV) sector achieved robust growth, with annual production and sales exceeding 10 million units for the first time. NEVs accounted for over 40% of the country’s total sales in 2024

Key Players

Export Capacity and Global Demand:

China’s exports of electric cars and plug-in hybrids, collectively known as NEVs, grew by 24.3% to 1.29 million units in 2024.

REUTERS

This significant export volume underscores China’s capacity to supply the global market. However, with increasing international demand and potential trade barriers, the sustainability of this growth is subject to various geopolitical and economic factors.

Two-Wheeler and Three-Wheeler Electric Vehicle Sales:

While specific figures for two-wheeler and three-wheeler electric vehicle sales in 2024 are not detailed in the provided sources, these segments have traditionally been substantial in China, contributing significantly to urban mobility solutions. The growth in these sectors is expected to continue, driven by urbanization and supportive policies.

Government Policies and Market Dynamics:

China’s supportive policies, including subsidies and infrastructure development, have been instrumental in driving EV adoption. However, the industry is currently experiencing a shakeout due to excess production capacity. Companies are responding by slashing prices and increasing exports to sustain themselves. Domestic brands are outpacing foreign brands, capturing 61% of the market. The competition is predicted to intensify, leading to more market exits and consolidations, especially among smaller players.

WSJ

Price Reductions by Major Manufacturers:

In response to market pressures, major manufacturers like Tesla and BYD have implemented significant price cuts to maintain competitiveness and stimulate demand. For instance, Tesla has offered notable discounts on its models in China, contributing to a broader price war within the industry.

WSJ

In summary, China’s EV industry is poised to maintain its dominant position in the coming years, driven by robust production capabilities, supportive government policies, and strategic market adaptations by key players

India Electric Vehicles Sales Statistics

India’s electric vehicle (EV) market has experienced significant growth, particularly in the two-wheeler and three-wheeler segments, which together accounted for approximately 94% of total EV sales in 2024.

AUTOCAR PRO

Electric Two-Wheeler Market:

In 2024, the electric two-wheeler segment saw sales of approximately 1.14 million units, representing a substantial increase from the previous year.

HT AUTO

Leading manufacturers in this segment include:

Ola Electric: Maintained a dominant position with sales exceeding 400,000 units in 2024, capturing a significant market share.

HT AUTO

TVS Motor Company: Achieved a remarkable growth of 123%, with sales reaching 182,959 units in 2024, driven by the popularity of the iQube electric scooter.

BIKELEAGUE INDIA

Ather Energy: Reported a 42% increase in sales, totaling 108,872 units in 2024, reflecting growing consumer interest in their electric scooters.

BIKELEAGUE INDIA

Bajaj Auto: Experienced a significant growth of 226%, selling 106,990 units in 2024, bolstered by the success of the Chetak electric scooter.

BIKELEAGUE INDIA

Electric Three-Wheeler Market:

The electric three-wheeler segment also demonstrated robust growth:

Sales Volume: Approximately 694,466 units were sold in 2024, marking a year-over-year increase of about 18%.

JMK RESEARCH

Market Share: Electric three-wheelers accounted for 35% of total EV sales in India in 2024.

AUTOCAR PRO

Overall EV Market Growth:

India’s total EV sales reached nearly 1.95 million units in 2024, reflecting a 27% year-over-year growth from 1.53 million units in 2023.

MERCOMINDIA.COM

This expansion underscores the increasing adoption of electric mobility solutions across the country, driven by supportive government policies, advancements in technology, and a growing consumer shift towards sustainable transportation options

The Future of the EV Industry

Key Drivers of Increasing Electric Vehicle (EV) Sales in India

Safety Features and Trusted OEMs

The growing focus on safety in EVs, combined with the entry of reputed Original Equipment Manufacturers (OEMs) like Bajaj Auto and TVS, has bolstered consumer confidence. For example:

Bajaj’s Chetak Electric: Known for its reliability and quality, has witnessed a surge in sales.

TVS iQube: Offers advanced safety features and cutting-edge technology, making it a popular choice.

Rapid Growth in the Three-Wheeler Segment

The electric three-wheeler market has become a cornerstone of India’s EV revolution:

Affordable Urban Mobility: Provides low-cost transport solutions for passengers and goods.

Dominance in Small Cities: Three-wheelers are highly favored in tier-2 and tier-3 cities for last-mile connectivity.

Localization of EV Components

The push for localized manufacturing of EV components is a major driver of cost reduction and supply chain stability:

Localization by Tier-1 and Tier-2 Suppliers: Companies are increasingly producing critical EV components such as motors, batteries, and controllers domestically.

Reduced Import Dependence: This has lowered costs and improved the affordability of EVs, fostering higher adoption rates.

Supportive Government Policies

FAME-II Scheme: Provides subsidies to EV buyers and manufacturers.

State-Level Incentives: Many states offer tax exemptions, registration fee waivers, and subsidies for EV adoption.

Infrastructure Development

The expansion of charging stations across urban and rural areas ensures better accessibility and convenience for EV owners.

Impact of These Drivers

The increasing involvement of trusted OEMs and suppliers ensures improved quality and safety.

Localization reduces costs, making EVs more affordable and competitive with ICE vehicles.

These factors, combined with government support, are expected to drive exponential growth in EV adoption in India